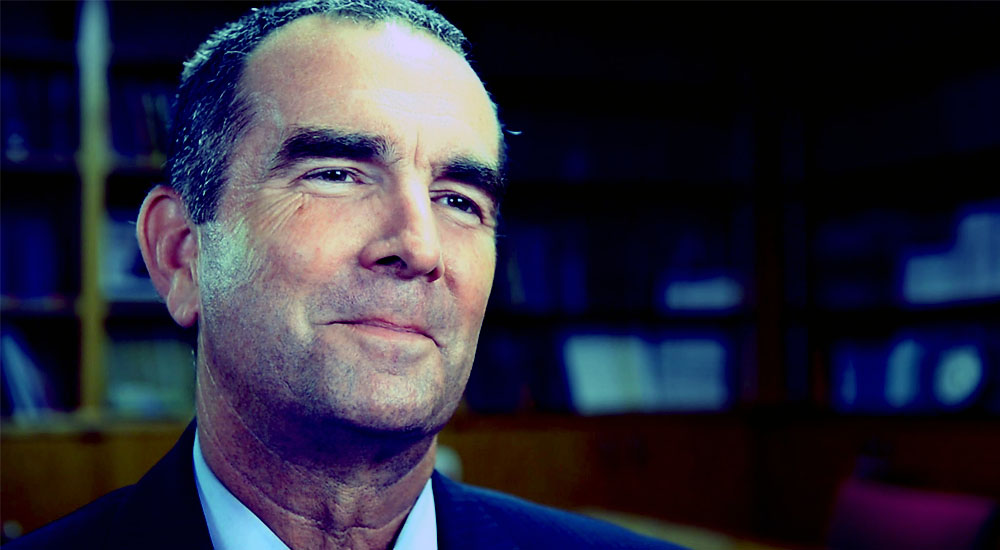

Governor Northam just proposed to make the “earned income tax credit” refundable, and while Northam calls it a tax cut for the poor, in practice it is a stiff tax increase to the working and middle class.

Currently, the tax schematic allows for the working poor and those who meet other requirements for the earned income tax credit (EITC) to eliminate all or part of your tax burden.

Yet under the proposed change from the Governor’s Office, Northam would send taxpayers a government check — even if you owe no taxes.

In practice, what Northam’s proposal amounts to is a welfare bonus, extra money paid out to those already receiving government benefits in the form of a no-strings-attached bonus check.

How does Northam intend to pay for this welfare bonus? By increasing taxes on middle class Virginians to the tune of $240 million.

This is where the scam gets intriguing.

Republicans in Congress just passed and President Trump signed historic tax cuts for 90% of Americans, the result of which has produced a minor economic boom that — despite tariffs and a trickling trade war with China — has seen GDP growth at consistent 4-5% rates over the last few quarters. After years of being told that nominal 2-3% GDP growth was the “new normal” by the Obama administration, this is an overwhelming net positive.

Yet as Virginia tax laws “conform” to federal tax law, this means Virginia has to make some tweaks to its law to realize the full effect of the federal tax code and avoid a middle class tax hike.

The simplest solution? Allow state tax payers to itemize their state taxes even if they do not itemize their federal taxes, a simple change endorsed by many Republicans which interprets into no $240 million tax increase (and no welfare bonus) for anyone.

Northam’s response to this simple fix has been to leverage it as a means to deliver the welfare bonus through a massive middle class tax hike, one that has the added benefit of benefiting the Democratic base at the expense of a Republican middle class.

What’s worse? Northam shields all his fat-cat donors from the tax increase, as well-to-do Democrats who itemize and don’t take the standard deduction never feel the impact of the shell game. In short, if you can afford an accountant, you don’t get a tax increase.

In an era where automation is threatening to radically change the nature of work and employment patters, trends towards the universal basic income — the brainchild of Milton Friedman — and the expansion of the EITC for low-income workers most at risk are worthwhile policy debates for the sake of a common good. Northam’s strategy of pitting middle class workers against low-income workers while shielding those who can most afford to contribute towards a solution seems more like political gamesmanship that policy solution.

Surely, Northam can do far better than regurgitate 20th century tax-and-spend handouts in order to tackle 21st century problems.