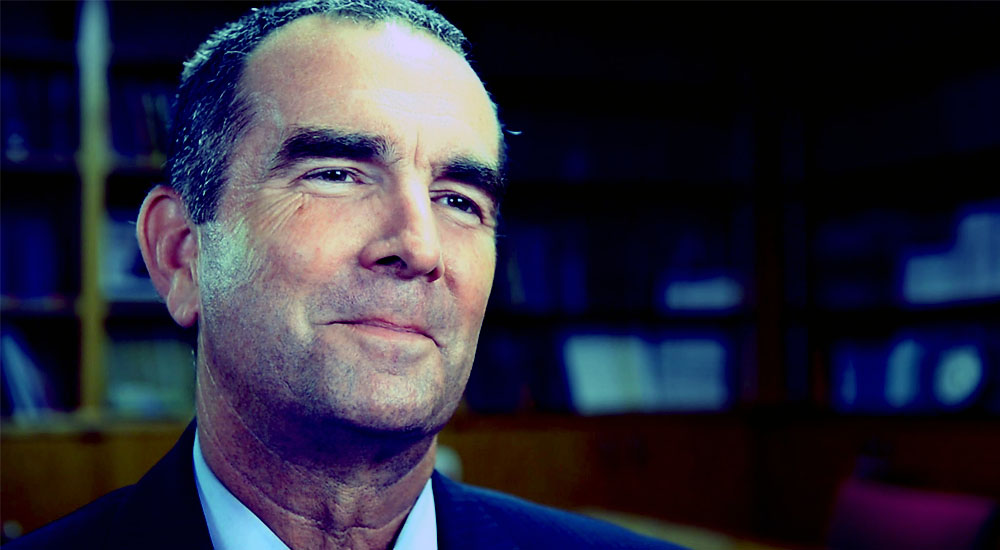

Following extraordinary tax collections this year by the Commonwealth of Virginia, more than double the projected rate, Governor Ralph Northam and the Virginia Legislature are currently debating what to do with $594 million in extra tax revenue. Rather than dedicate funds to improving roadway infrastructure, pay for modernizing crumbling schools, or fattening the rainy day fund, Governor Northam has proposed to make the earned income tax credit (EITC) refundable. While Northam calls it a tax cut for the poor, in practice, it is a stiff tax increase – $240 million worth – to the working and middle class.

Currently, the tax schematic allows for the “working poor” and those who meet other requirements to qualify for the earned income tax credit (EITC) to eliminate all or part of one’s tax burden. However, under the proposed change from Virginia’s executive branch, government checks would be sent out to taxpayers — even if one owes no taxes.

Recently, POOLHO– USE and Cygnal conducted a poll on Virginians about this measure. On Wednesday, the released findings showed that 60 percent of residents in the Commonwealth prefer the plan from House Republicans, returning the taxes to the middle-class taxpayers by allowing them to keep existing state tax itemizations they would lose under Governor Northam’s plan. Just 29 percent supported Northam’s plan of direct payments to low-income families who qualified for the EITC.

The governor could rectify this situation in tax conforming state by allowing state tax payers to itemize their state taxes even if they do not itemize their federal taxes. this is a relatively simple change endorsed by many Republicans. However, it seems that the Democratic response is to deliver a welfare bonus through a massive middle-class tax hike, one that has the added benefit of subsidizing the Democratic base at the expense of a Republican middle class.

Furthermore, Northam shields all his high-dollar donors from the tax increase, as well-to-do Democrats who itemize and do not take the standard deduction never feel the impact of the sleight of hand.