Tucked into the new Biden-Pelosi tax grab being debated on Capitol Hill this September isn’t just a lowering of the threshold for high income earners — down from $523K to $400K. To make matters worse, small businesses who make more than $5 million a year will be taxed an additional surprise 3.8% surcharge by the federal government.

Among other items in a rather extensive tax grab, from the Wall Street Journal:

If you make more than $5 million, there will also be a three-percentage-point income-tax surcharge. That would take the top tax rate to something like 46.4%. Add California or New York taxes, and government will take about 60%. Hilariously, the committee figures the surtax will raise $127 billion in revenue, as if the rich will be dumb enough not to find tax shelters.

The House proposal will hit small businesses that pay taxes through the individual code especially hard. They’ll pay the higher individual rates, including a new 3.8% surtax on small business income, and they’ll pay on more of their income because the Democratic proposal eliminates the 20% deduction on qualified business income.

That would put US taxes on businesses higher than that of Communist China.

That deduction was designed to equalize the tax burden for passthrough and Subchapter S companies with corporations. Now it will vanish for individual business owners who make more than $400,000. This will mean less hiring and fewer raises for the employees of these firms.

More alarmingly, the death tax exemption aimed at “wealthy” Americans yet ironically punishes land rich but cash poor farmers and other intangible asset holders (think small businesses) is about to gets slashed in half. Stack that on to inflation concerns and the cheapening of the US dollar, and you can understand how grandfathers and grandmothers looking to pass on the family farm might now be forced to make other decisions:

The death tax exemption would also be cut in half to $5.5 million—which would also hit small businesses and savers who have built up a small nest egg. If Republicans don’t pound away on this assault on small business, they should retire from politics on grounds of incompetence.

Anyone heard a thing about this yet? We might have our answer.

Don’t worry — things get worse for corporations in general. Like most tax increases, the costs are rarely carried by the corporation itself… woke capitalism will simply pass the cost right on to the consumer and the taxpayer accordingly:

Corporations come in for a $900 billion fleecing, with the top tax rate rising to 26.5% from 21%. Add state and local corporate levies, and the 31% average rate will vault the U.S. back to the highest in the developed world. Congratulations, we’re number one. The higher rate soaks some $540 billion from U.S. corporations, and the bill snatches another $360 billion in a complicated grab-bag of levies on overseas income.

In short, the high-growth economy of the Trump administration that was just about to kick off on all cylinders is about to get swapped out with a hamster wheel — all courtesy of Joe Biden and Nancy Pelosi.

New taxes on tobacco and nicotine? $96 billion, folks… which means the price of everything from cigars to Marlboros (and vapes) is about to skyrocket. No news on whether marijuana will get the same treatment from the feds (yet).

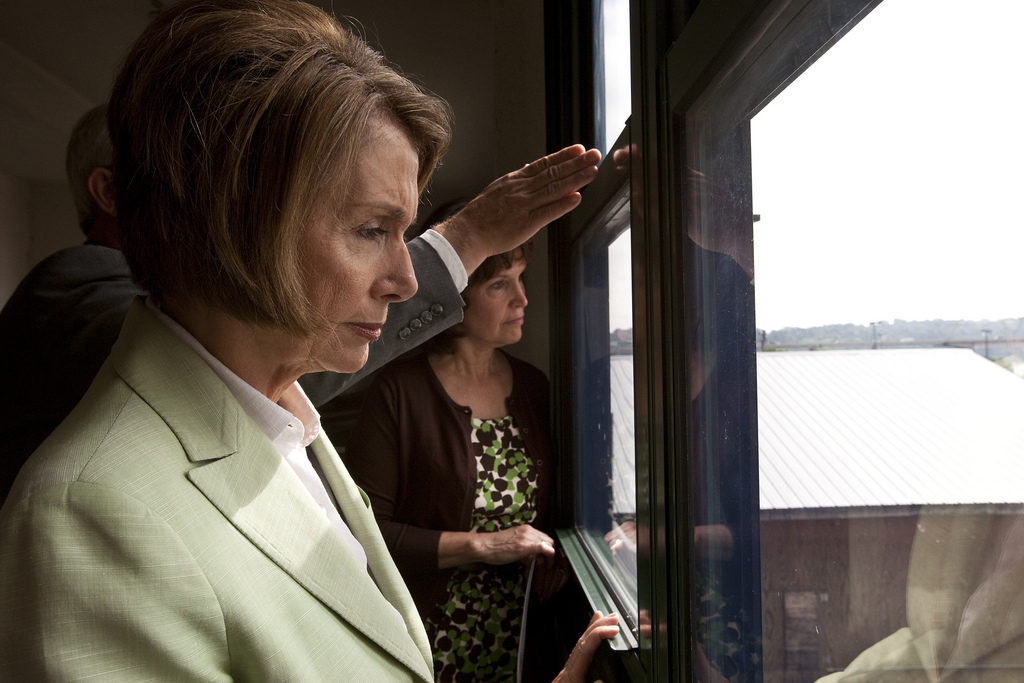

Pelosi is all but guaranteed to pass this tax bill through the Democratic controlled US House of Representatives. Whether or not a 50-50 US Senate can stop the spending bill is anyone’s guess, as Democrats are quickly maneuvering to use a procedure that would prevent Senate Minority Leader Mitch McConnell from exercising the filibuster — a move very close to the nuclear option that Democrats love in the minority and castigate in the majority.

Republicans in Washington are starting to circle the wagons as more details of this bungled tax plan come to light. If the punitive nature of the tax plan on small business is any indication as to who is going to carry the load? The answer isn’t going to be those in power who can afford the tax hikes, but those struggling to create better lives for their families and communities.