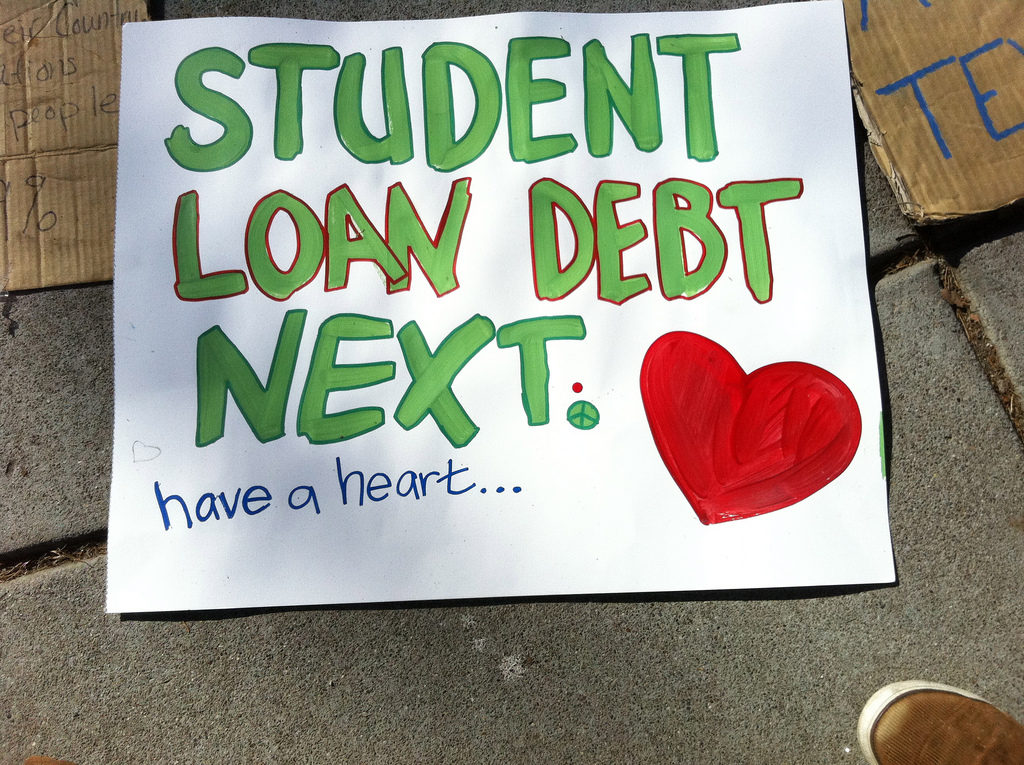

As national student loan debt reaches almost $1.5 trillion, throughout Virginia, students will be tasked to borrow more than normal if they seek a college degree as in-state tuition and mandatory fees for matriculation at state universities and community colleges has increased by an average of 5.1 percent or $612 for the 2018-2019 school year. In a report from NBC 29, the State Council of Higher Education for Virginia released a report to state lawmakers and found that students at four-year institutions will pay an average of $13,370 while community college students will pay an average of $4,620.

Moreover, room and board charges and fees at four-year schools will average $10,633, an increase of 3.5 percent from last school year.

Student Loan Hero reports that loan debt among college borrowers is now $620 billion more than the total U.S. credit card debt. Approximately 44.2 million Americans of all ages carry student loan debt, with a 11.2 percent delinquency rate – those 90 or more days delinquent or in default.

For a borrower between the ages of 20 and 30 years old, the average monthly student loan payment is now $351, with a median figure of $203.

Students in Virginia have consistently paid more through year-over-year increases since the trend began in 2002. The Commonwealth is home to some of the highest in-state tuition and fees in the country.

The Free Lance-Star reports that 62 percent of Virginia students graduate with student loan debt, putting them an average of $29,974 in the hole, compared with 57 percent of graduates before the Great Recession, who carried an average of $20,039 in student loans.

A few bills passed through the Virginia General Assembly this year in an attempt to help the one million Virginians which hold over $33 billion in student loan debt. The bills are new efforts to increase transparency in student loan borrowing in the Commonwealth.

One was to establish an Office of the Qualified Education Loan Ombudsman, which would assist potential students in obtaining loans, but also educate them on how to pay them off without accruing numerous late fees and eventually falling into default. Lawmakers are also hoping to establish a line of open communication between loan providers and borrowers to better educate people before they take out loans for college.