Unemployment is down to 4.2% and September’s jobs dipped about 33,000 in the first dip in seven years.

Three reasons? Harvey, Irma, and Maria.

…and there are three reasons to be optimistic. First and foremost? The nature of the dip, from Calculated Risk:

However wages were up, and the unemployment rate down (the household survey counts people as employed even if there weren’t paid during the reference week – like those in hurricane impacted areas).

Wages are up, part-time work for economic reasons is down, and unemployment are all down. These are net positive signs of a sluggish but cautiously optimistic recovery.

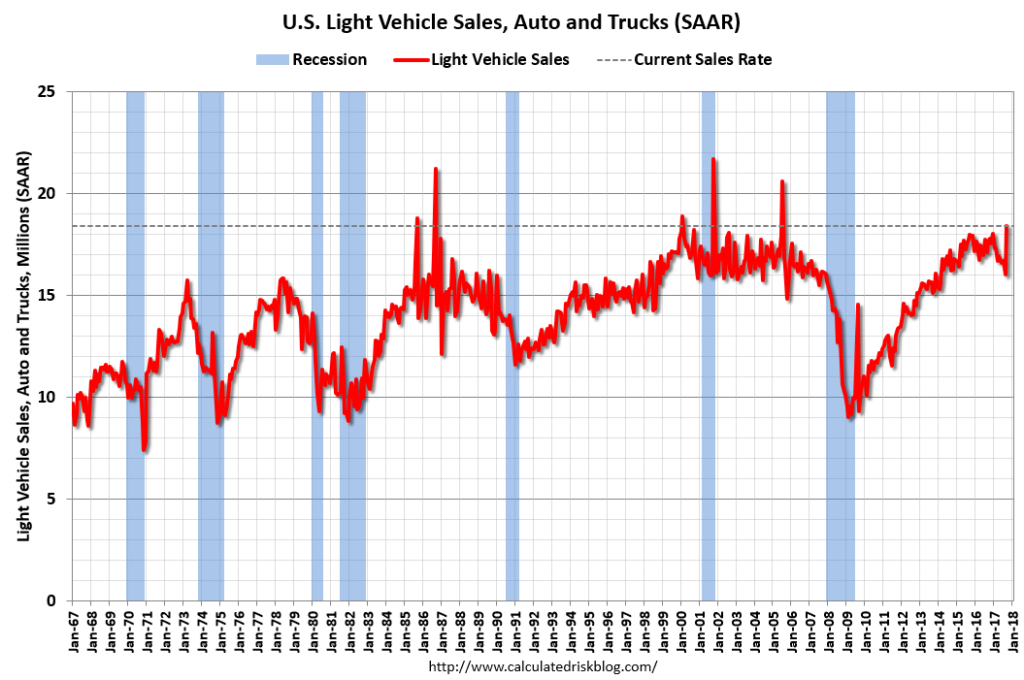

Second, the one number that I pay attention to most as to whether or not the economy is picking up? Light auto sales… and they were up sharply in September:

Based on a preliminary estimate from WardsAuto (ex-Porsche and Hyundai), light vehicle sales were at a 18.4 million SAAR in September.

That is up 4% from September 2016, and up 14.8% from last month.

So is it an outlier? Yes — of a sort:

Two things to note here. First is the dip in auto sales over the last three years, which is much more of a correction within the auto industry than it is with the economic condition of American consumers — 2017 is actually on track to be the fifth-best year for the auto industry of all time. Second, as an economic indicator, auto sales are perhaps the best gauge as to how a national, state, or local economy (think Virginia Commissioners of Revenue) is actually doing — few people take on a $400/mo car payment over 5 years if they aren’t secure in their economic prospects.

Last and perhaps most important? The prospects for national tax reform from Washington this year. Critics have implied that the shift is tax-neutral rather than an overall tax cut, yet the reforms are enjoying broad bi-partisan support even if the current political climate refuses to cede an inch to the opposition.

With the passage of the first budget in a long time from the U.S. House of Representatives and a deal brokered by the White House with Senate Democrats, the first green shoots of a return to “regular order” (in the words of Senator John McCain) are in the offing. Meanwhile, as the European Union continues to grab liquidity at an alarming rate by punishing multinationals, the United States once again stands to benefit from the sclerosis of our European cousins.

In short, while there are some traditional oddities in the current economic outlook — a Wall Street bubble that appears to be more of a house bet on tax reform than anything else — the current economic forecast looks to be stable, positive, and rather mundane — barring any black swan events such as hurricanes or conflict, that is.