While there has been much celebration at the passage of a new $188 billion biennial budget for Virginia, this deal would not have been possible had there not been close to $1.06 billion in higher-than-expected tax revenue ($1.2 billion by the end of the year) to cover the massive spending increases sought by the Democrats in the General Assembly. This bonus revenue allowed Gov. Glenn Youngkin (R) to achieve his goal that taxes not be raised, and Democrats to get their demand that spending be dramatically increased. It is like magic!

What no one is discussing is the source of this “magic” revenue. It is not just from a growing economy. Put simply, there is a “stealth tax” in Virginia that is leading to an increased tax burden for Virginia residents, and thus, higher revenue for the Commonwealth’s appropriators. This stealth tax is the bracket creep that occurs with higher inflation when the tax code does not index their brackets, deductions, and exemptions to account for that inflation. Virginia and sixteen other states with graduated income tax schedules, do not adjust those brackets for inflation.

Thus, as inflation pushes wages nominally higher, taxpayers get pushed into higher tax brackets even though their purchasing power has gone down. Unindexed deductions and personal exemptions add to the problem. Standard deductions lose value with inflation. If the deduction does not increase with rising costs due to inflation, taxpayers get less tax relief, effectively raising their taxable income.

Inflation also increases the government’s take from real estate and motor vehicle taxes, based on fair market values, but local governments can and often do reduce those tax rates to minimize the impact on their citizens. The state has proven far less likely to do that with its income tax collections, or its own taxes based on property values.

Inflation results in a massive tax increase. Fortunately, in the previous two years, as inflation has skyrocketed under President Biden, Governor Youngkin with bipartisan support has been able to return a large portion of this “overpayment” of taxes due to inflation to taxpayers in the form of tax rebates. The standard deduction has also been raised, but the changes only compensated for prior inflation. It is already eroding again. Personal exemption amounts and the tax brackets were not adjusted.

The newly elected General Assembly, with Democrats in control of both chambers, had no interest in returning this overpayment to taxpayers as sought by Governor Youngkin, instead opted to use these funds to increase government spending. From across-the-board teacher and government employee pay increases, reduced tolls in Hampton Roads, and increased mental health spending — the added revenue without an explicit tax increase gave the appearance of “free money” that allowed this spending spree by the General Assembly.

Without action, this stealth tax will only get worse. Just yesterday, the Labor Department reported that wholesale prices (PPI) jumped to their highest level of the year. Today, it is expected that the consumer price index will also show a higher-than-expected increase. These numbers will almost guarantee even more surpluses, leading to even greater spending unless Virginia reforms its tax code.

Inflation impacts the poor the most as they spend a greater percentage of their income on essential goods like food, rent, and utilities – where cutting back is impossible. The wealthy can merely cut back on non-essential items to account for price increases, the poor cannot. Compounding this issue for the poor is the added taxes they face as the value of their deductions is reduced by inflation, and as their added wages to make up for inflation push them into higher tax brackets.

There is a joint tax policy subcommittee that the Democratic-controlled legislature established in 2021 to review potential changes in the tax code. So far it has been inactive, but the new budget included language directing it to begin work on exploring revenue options and needs, with a reporting deadline of November 1, 2024.

Of concern is the following paragraph:

4. The Joint Subcommittee shall explore efforts to modernize the Commonwealth’s income and sales and use taxes during the 2024 interim. The goals and objectives shall include: (i) evaluating existing sales and use tax exemptions; (ii) applying sales and use tax to digital goods and services, including transactions involving businesses; (iii) evaluating efforts to increase the progressivity of the income tax; (iv) and long-term revenue growth to maintain core government services.

Sen. Louise Lucas (D-Portsmouth), who chairs the Senate Finance Committee, highlighted this effort in her remarks after the passage of the budget. She and others wish to ensure there is enough revenue for their growing list of spending priorities – including an economically destructive expansion of the sales tax to “business to business” digital transactions. She and fellow Democrats may be worried the next President will break the inflation cycle and the “stealth tax” will stop producing its bumper crop.

Before any new tax is considered, the existing code should be indexed so that taxes are more transparent to taxpayers, the true value of deductions remains consistent and any new spending requires either a booming economy or a tax increase properly approved by legislators and our governor.

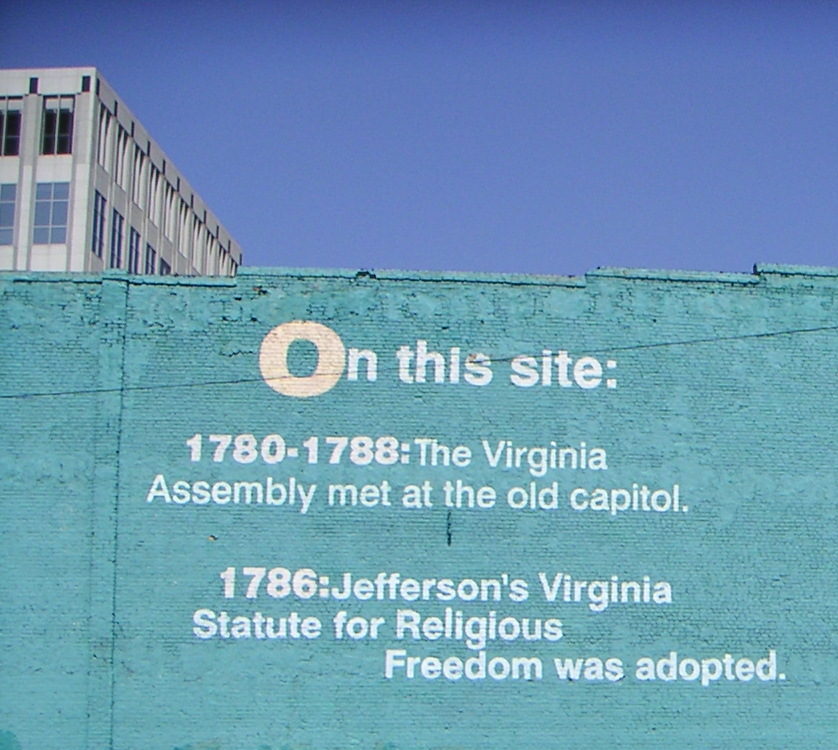

DERRICK MAX is the President of the Thomas Jefferson Institute for Public Policy and can be reached at dmax@thomasjeffersoninst.org. This column was first published by the Thomas Jefferson Institute.