Jim Bacon writes on the continued theme of fiscal stress in the wake of the COVID economy, adding to long-standing fiscal pressures as rural Virginia localities leech workers and talent to urban and suburban communities:

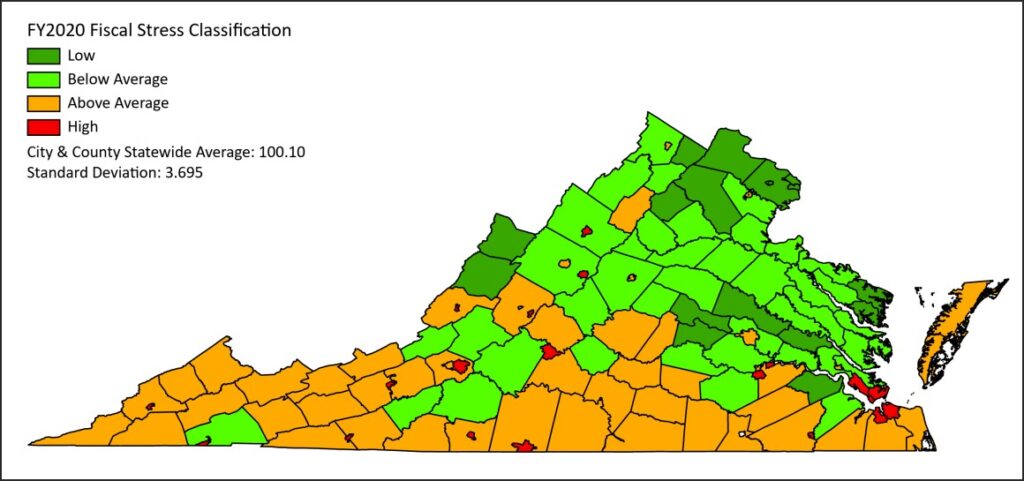

No surprises here — the same geographical patterns hold as in the past. The most stressed localities are uniformly cities, and the most stressed are small cities. The least stressed are counties in Northern Virginia and on the metropolitan fringe of Richmond. Two remarkable outliers, Bath and Highland counties, seem to be in great shape relatively speaking. View the report for details of your jurisdiction.

More interesting to me is the inclusion of GO Virginia regions in the appendices of the report, which indicates the pitch for regional solutions to local roles such as economic development and land use may be picking up steam and gathering interest in Richmond.

Of note, the category of “fiscal stress” is a relative term divided by quartiles, meaning that the lower 25% of the bracket may (or may not) be under any sort of true fiscal stress, but rather that they simply are not doing as well as some of their northern Virginia localities.

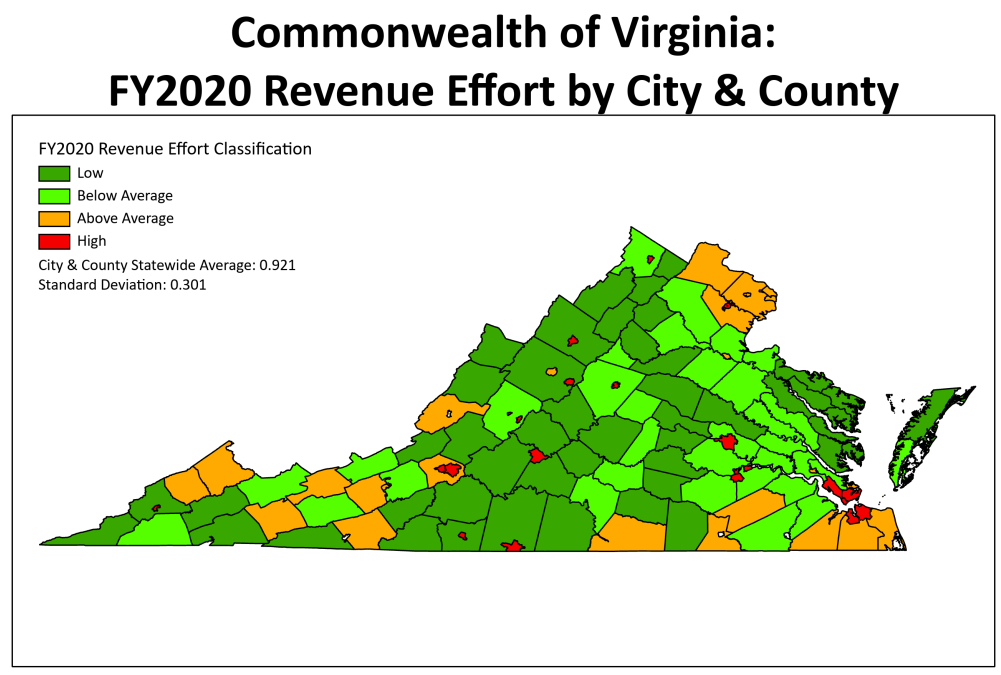

Perhaps more concerning for property owners is the revenue effort page, namely whether or not the locality itself is able to sustain a higher tax rate:

This number is also a relative number against the median ($1.0051 of tax revenue per ever $1 of capacity) with Virginia’s cities skewing the near total — and coincidentally, having a greater number of tools at their disposal — against localities which ultimately rely upon real estate property taxes.

This number is also a relative number against the median ($1.0051 of tax revenue per ever $1 of capacity) with Virginia’s cities skewing the near total — and coincidentally, having a greater number of tools at their disposal — against localities which ultimately rely upon real estate property taxes.

Over the last 10 years, the CLG report finds that Virginia localities on average have increased the local burden by 0.13% based on capacity vs. tax revenues, meaning that on the balance local tax rates have kept up with the intangibles such as cost of living, increased home values, and inflation.

Flip side of this argument is that Virginia’s cities eat the lion’s share of this tax revenue, while Virginia’s counties tend to be far more moderate in their consumption of the public weal.

Somewhat shocking, the median household salary growth since 2011 is only 2.7%, with the Golden Crescent from Washington to Richmond to Virginia Beach dominating the incidence rate of growth against Virginia’s western half.

So Why Include GO Virginia Regions?

More interesting to me is the overlay of GO Virginia regions, territories which somewhat overlay Virginia’s planning district commissions (PDCs) but do not necessarily correlate with Virginia’s regional growth patterns.

Commonly discussed in Richmond but not openly discussed elsewhere is the overlap of Virginia’s localities and certain duties and responsibilities. For instance, economic development is a key driver where a great deal is spent (and often times at odds) where a simple application of Nash’s Equilibrium would do.

For example, while one may not see a Googleplex be magically dropped into rural Virginia, one might see that dropped in an urban setting with all the right (and existing) infrastructure requirements — pad sites, roads, public transportation, mixed use, aviation, etc. — that would most certainly have positive results for nearby suburban localities in terms of intersecting economies. Landing the Googleplex is one thing; landing the professional services and commercial growth to attend to all the things the employees of the Googleplex might ask for is a whole other ball game. In this way, everyone competes in the same direction as a region rather than competitively, and especially when it’s not a Googleplex but something far smaller.

Co-operation on economic development isn’t the only area where regions can and ought to collaborate. Many in Virginia have long complained about the disconnect between land use and transportation. Regional approaches to both would not only help link local land use decisions to the Virginia Department of Transportation’s six-year plan (i.e. which of your roads gets paved or improved and when), but it would also help ameliorate the cycle of sprawl that has plagued Northern Virginia and its exurbs, and to a smaller degree the greater Richmond and Hampton Roads areas.

Of course, GO Virginia is not precisely a clearinghouse for a fourth layer of government subsidized by the local and state Chamber of Commerce. Far from it, if there is to be a nerve center attending to some of these functional problems regarding the interaction between local and state government, GO Virginia is precisely where you’d want that nexus to be. Moreover, the project isn’t run by either small businesses or local technocrats, but rather in a collaboration enhancing the interest of both and to the benefit of the local taxpayer (i.e. keeping that “revenue effort” at a minimum).

The primary obstacle to GO Virginia’s efforts are threefold. First and foremost are concerns from localities about surrendering their autonomy. Second are objections from both rural conservatives and urban progressives about the nature of a “fourth layer of government” and its ability to issue (or not issue) debt. Third and perhaps tertiary is the question “cui bono?” in any instance where localities are leaning upon PDCs (or some other entity) for economic strength where the Virginia constitution mandates the consequences as being caught by local governments — in other words, PDCs and GO Virginia get the “fun part” of local government (economic development, transportation, land use) while localities get the “expensive part” of local government (education, deputies and courts, social services, etc.)

Yet while these objections are serious ones, they need not be insurmountable. Local governments should understand that their autonomy — while prized — is an expensive luxury in the face of multi-billion dollar growth which can roughly cannibalize a local government. More serious-minded oversight from a Planning District Commission could help either ameliorate fears of large projects or cast cold water on projects where local elected officials can either feel pressured or in some cases just plain bought. Concerns about a fourth layer of government issuing debt or otherwise restraining or forcing localities to “buy in” on projects should be viewed as a tradeoff worth the exchange. Costs being shared, rural localities can force urban ones to pause on expensive boondoggles while urban localities can help rural ones apply more vision and expedition — a tradeoff that cools passions while lifting eyes to the horizons. Finally, the answer to “who benefits?” is rather simple and direct — the local taxpayer. Real estate property taxes remain a 19th century tool applied to 20th century solutions. If Virginia intends to compete in a 21st century economy, GO Virginia is raising the right questions indeed.

The shift to regional solutions isn’t an idle one. In the 1950s, the cities of Charlotte and Norfolk were roughly the same size. Today, Charlotte is an international hub while Norfolk remains balkanized among its neighbors in Hampton Roads. The simple reason why this is the case is that in North Carolina, Charlotte took a regional approach to development and growth. In Virginia, cities began a process of annexation that was highly contentious through the 1970s and early 1980s, ultimately freezing out city governments and drawing a firm line between municipal and county government based on where water and sewer lines stopped. Thus Richmond was able to gobble up the better parts of Henrico County while county governments made the radical shift to be called cities themselves — Princess Anne County becomes Virginia Beach, Nansemond County became Suffolk, and in the cruelest twist of fate of all, Norfolk County (distinct from Norfolk City) became Chesapeake.

Whether or not the CLG’s report gets the circulation it deserves remains to be seen. The good news overall is that Virginia’s localities — while stressed — are benefiting from an expanding federal bureaucracy in Washington that is lifting many boats by allowing the growth in local government to increase at pace with the community’s ability to afford.

They key word in this is afford.

It is no small secret that Richmond believes that Virginia’s localities can and ought to shoulder more of the public burden. The question is how to do this without completely rewiring how Virginia’s localities tax its citizens. Former Governor Jim Gilmore’s effort to axe the car tax was a famous 1997 pledge that Virginia Republicans have yet to keep; former Governor Tim Kaine’s parting gift to the General Assembly recommending a 1% income tax as a substitution for the real estate property tax landed with a thud when it was offered in 2010.

Yet as Virginia continues to grow and the demand for public services increases, how to tackle the wider problem of balancing public need with economic growth is a 21st century problem the requires 21st century tools.