The final version of a regulatory revision for Dominion Energy Virginia restores State Corporation Commission authority over the utility’s profit margin and rates, a major goal for Governor Glenn Youngkin (R). It was also the highest priority in a detailed energy policy put forward by the Thomas Jefferson Institute for Public Policy.

Of the aggressive goals set out in Dominion’s initial legislation, few were accomplished in the end. The General Assembly did agree to directly legislate a profit margin for the utility for two years, and it is an increase. Come 2025 the SCC will be free to set the next profit rate without any reference to the peer group of other utilities now required by law.

Setting a directly stated return on equity of 9.7 percent, right in the text of Virginia law, has never been done. The promise is the General Assembly and utility won’t ever do it again. Past promises in prior utility legislation have not always held for long. In this case, Governor Youngkin should still be around to prevent any backsliding, but precedents are precedents.

The bill as passed also mirrors separate legislation restoring the SCC’s full authority to raise or lower rates, an accounting process that is interrelated with determining the allowed profit margin. It will depend on economic conditions in 2025, but the profit margin set by the SCC may or may not be lower than 9.7%. Having the SCC decide that, however, is a return to proper regulatory policy.

Also gone for the future is the unique-to-Virginia return on equity “collar” which added another 70 basis points (0.7%) to the allowed profit margin. With the increase in the official return on equity from 9.35 to 9.7%, Dominion is getting half of it back, at least. The collar didn’t apply to all of its operations, but this higher base profit margin will, so it is largely a wash.

The profit margin on the massive Coastal Virginia Offshore Wind project, for example, is now 9.35% with no collar. This legislation increases that to 9.7%, an extra $3.5 million in annual profit on every $1 billion of equity capital.

The peer group for return on equity decisions, and the rate collar allowing utilities to keep excess profits, also go away in approved legislation changing the rules for the state’s second largest electric provider, Appalachian Power Company. The two companies will be operating under different regulatory regimes if both become law, a step backward to counteract some of these steps forward.

The one area where the General Assembly, or least the Democrats who control the Virginia Senate, refused to return power to the SCC was over the generation mix for Virginia utilities. There, a future SCC is still bound by numerous dictates imposed by past Assemblies to rapidly retire fossil fuel generators and replace them with a massive investment in wind, solar and batteries.

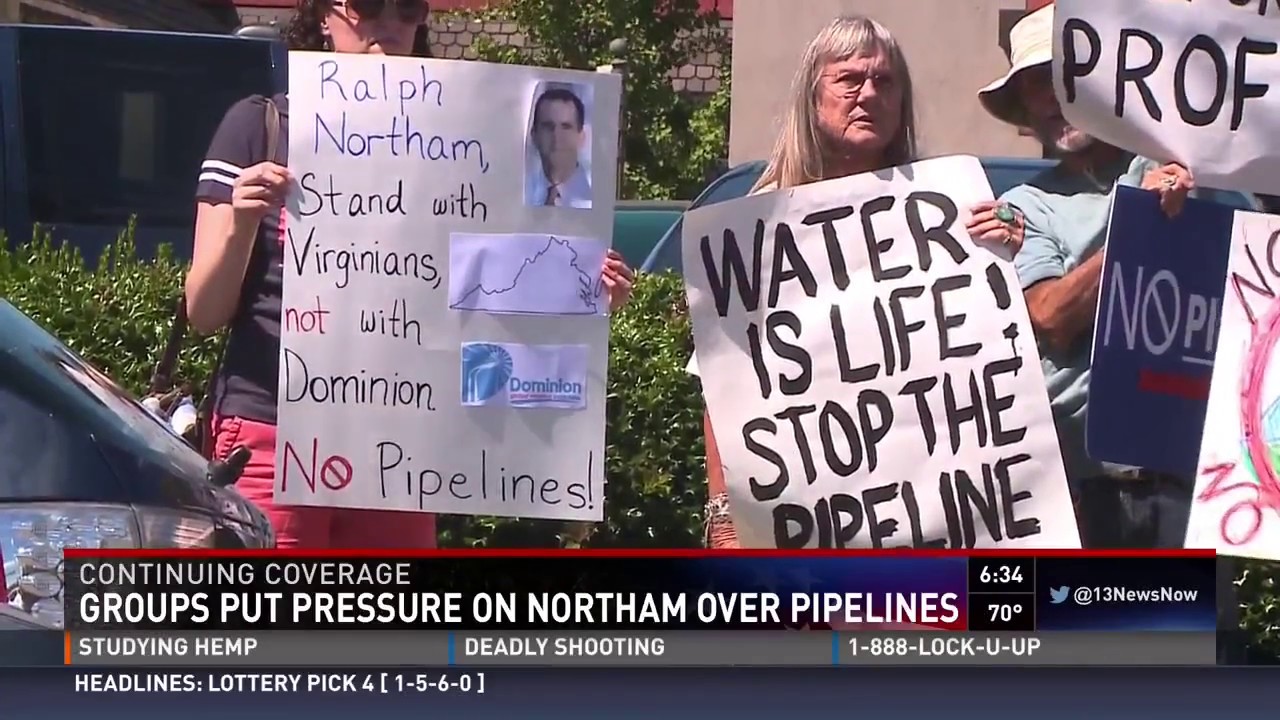

The best element of Dominion’s initial bill was it gave the SCC a stronger hand in controlling the pace and nature of that conversion, directing it to make system reliability the key to its decisions. That was a complete reversal of the approach laid out in Governor Ralph Northam’s (D) Virginia Clean Economy Act. The idea survived in House versions of the Dominion bill but disappeared immediately in Senate versions. It didn’t make the cut in the conference report.

Democrats claim that the Virginia Clean Economy Act will allow the SCC to keep a fossil fuel plant open, or reject a renewable investment, on the basis of reliability. The SCC itself, in a report late last year, warned that it lacked the power to keep Virginia’s reliability high. Concerns are going to grow, not fade.

The legislation as it heads to the Governor still includes Dominion’s proposal to take several of its stand-alone rate adjustment clauses (RACs), now billed individually, and merge them into the lump base rates. The claim is that will “save” consumers $350 million, which it will not, but the disappearance of those monthly charges could create an appearance of lower bills.

Using base rate dollars to replace the dollars collected by those RACs means any excess profit that otherwise might occur will disappear, preventing any refunds to customers. They could save $350 million on the bills but lose $350 million in refunds.

That’s why claims that this legislation will reduce electric bills are slippery. The Richmond Times-Dispatch, in its report February 26, mirrored Dominion’s advertising claims and stated it will produce an “immediate” reduction of $6-7 for many residential customers, based on the RAC conversion. In his victory press release, Governor Youngkin was more careful, stating the legislation will “save customers money on their monthly bills.”

Comparing this bill to what Dominion introduced weeks ago, the Governor’s statement is correct. Dominion was seeking a much higher legislated profit margin with no sunset on the peer group. But there are so many moving pieces in the electric bill, so many expensive projects like the offshore wind complex and nuclear reactor upgrades are soon to be added, it is impossible to predict where a family’s cost will be in one year or two.

Another major cost element that remains impossible to predict is the price of fuel. This conference report includes Dominion’s proposal to allow the SCC to spread that cost over multiple years, with interest. Basically it would create a bond to cover part or all of the $1.6 billion in fuel costs it ran up when prices spiked after Russia attacked Ukraine.

Those fuel costs, mainly natural gas, have since dropped substantially. If the unpaid backlog is amortized over a long period, in the short run the customer bill will be lower but in the long run the total cost is far higher. As the time period lengthens, the total interest paid starts to pile up, just like with a credit card when you make only the minimum payment.

Dominion in written arguments for the bill provided some examples from other states. In one, a big fuel bill would have added $39 to monthly bills if paid off over a year ($468), but only $5.64 per month if paid out over ten years ($676.80 in total). That extra $209 (45% more) will be collected by some lender. Is that saving customers money? No, but it will sure look like it has between now and the next election.

The final Dominion and Appalachian bills both include provisions where the state’s largest users can just pay off the fuel arrearage in twelve months, avoiding those years of interest costs. The option is only granted to the largest customers, those with lobbyists watching out for them. When they opt out of something, the smaller customers should beware.

STEVE HANER is Senior Fellow for the Thomas Jefferson Institute for Public Policy.