Early Wednesday, President Donald Trump unloaded on multiple Republican Senators who are opposing his impending …

Virginia's Public Square

Virginia's Public Square

Early Wednesday, President Donald Trump unloaded on multiple Republican Senators who are opposing his impending …

President Donald Trump has announced a one-month delay on the 25% tariffs targeting USMCA-compliant goods …

On day one of his new administration, President-elect Donald Trump is expected to announce the …

President Joe Biden signed the so-called “Inflation Reduction Act” this afternoon. #BREAKING: President Joe Biden …

Hardscape Manufacturer Unilock to invest $55.6 million in new production facilities in Hanover County to …

If investment returns for Virginia’s pension system come in around negative 6%, the commonwealth’s unfunded …

In an official announcement from Governor Youngkin, the board in control of cosmetology licenses in …

Governor Glenn Youngkin announced that 11 companies across the Commonwealth have graduated from the Virginia …

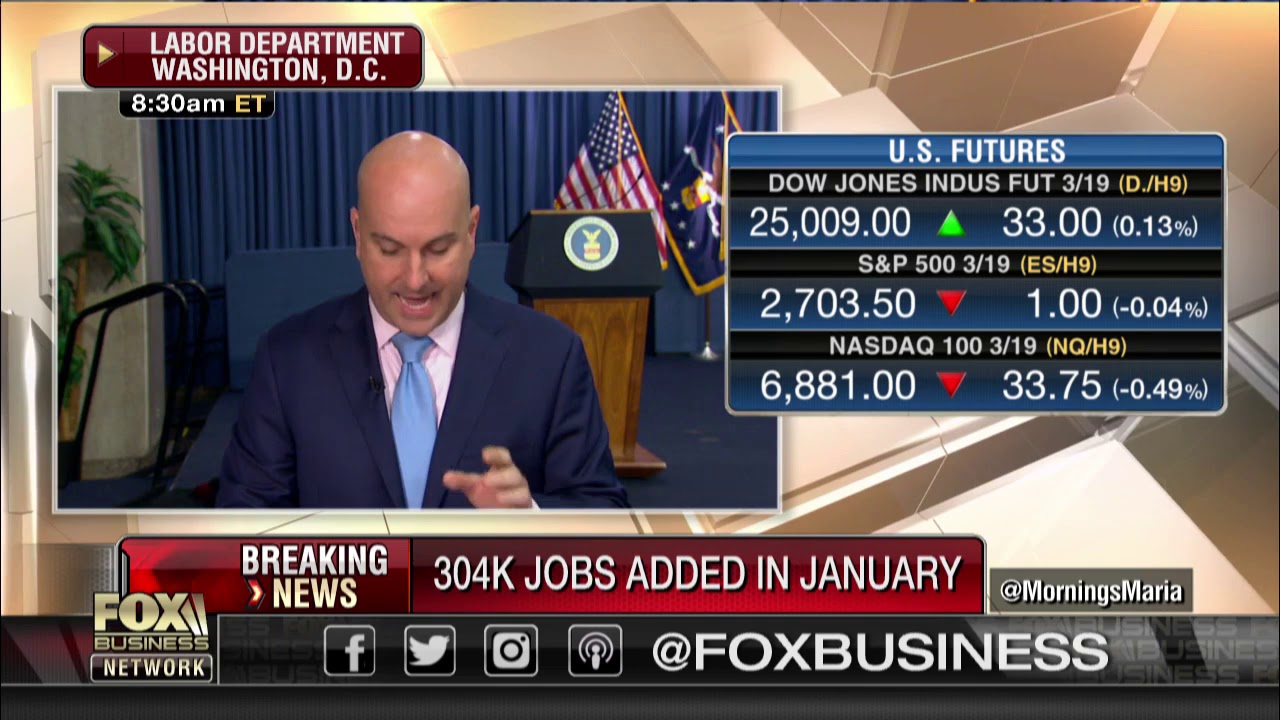

Despite a 35-day partial government shutdown that affected over 800,000 federal employees, the January jobs report absolutely shattered expectations. The U.S. Labor Department reports that non-farm payrolls surged by 304,000 last month.

Private sector payrolls were up by 296,000, with big increases seen in the construction and leisure and hospitality industries.

The unemployment rate, however, did tick up 0.1 percentage point to four percent, largely as a result of the longest government shutdown in U.S. history. Regardless, January was the 11th consecutive month that the unemployment rate has been at or below four percent.

According to a report from CNBC, economists had expected payrolls to rise by 170,000 and the unemployment rate to hold steady at 3.9 percent.

Although the economy is said by many market analysts to be slowing down, the month of January marked 100 months in a row of positive job creation, the longest streak on record.

There were two big corrections that were made for previous month’s numbers. December’s gain of 312,000 jobs was knocked down to 222,000, the largest revision since November 2014. Meanwhile, November’s job gains were hiked from 176,000 to 196,000. The corrections brought the three-month average to 241,000, still trending well in U.S. economic expansion.

For the full year of 2018, the average monthly jobs gain was 223,000.

Even though the number of Americans employed slid down to 156,694,000 from 156,945,000, the U.S. labor force participation rate is now at 63.2 percent, the highest under President Donald Trump.

The U-6 metric, a figure used to measure unemployment that takes into account discouraged workers and those holding part-time positions for economic reasons did rise to 8.1 percent from 7.6 percent, on track with January 2018.

The Labor Department also reported that average hourly earnings rose by 3.2 percent year-over-year in January – the sixth month in a row above three percent. Average weekly earnings fared better, rising 3.5 percent year-over-year.

“As the jobs and employment data normalizes over the coming months, we are confident the nation’s economy will continue to build on the strength seen in 2018 and the first report of 2019,” said Labor Secretary Alexander Acosta.

Following increased market volatility and the slowing of global growth at the end of last year, the Federal Reserve is set to take a less aggressive approach to interest rate hikes in 2019 after the U.S. central bank instituted four rate increases in 2018.

Employment projections through 2024 show that Virginia’s economy is set to grow 9.4 percent, exceeding the national growth rate of 6.5 percent.