The first push in flipping the Commonwealth red is the upcoming 2019 elections, with all 140 seats in the General Assembly on the ballot in November.

Virginia's Public Square

Virginia's Public Square

The first push in flipping the Commonwealth red is the upcoming 2019 elections, with all 140 seats in the General Assembly on the ballot in November.

Measures to mitigate human and sex trafficking were a large part of the Republican Party’s agenda in the 2019 legislative session in Richmond, which included other bills to enhance the criminal justice system.

Both bills were approved as “emergency” legislation, meaning their provisions will become effective as soon as they are signed by the governor.

Bolstering innovation, job creation, and talent acquisition and production, House Republicans secure cost-lowering measures for Virginia college students.

As Republicans remain unified behind tax relief, Democrats remain committed to emptying the pockets of middle-class Virginians.

Ralph Northam, Virginia’s moonwalking, formerly-blackface governor, will not resign, but says he will “revisit” the decision if he is not “effective or efficient.”

Virginia’s middle class is one step closer to much-awaited tax relief.

This morning, Republicans in the House Finance Committee advanced a package of legislation aimed at easing the tax burden on the middle class, blocking Governor Ralph Northam’s planned tax hike, expanding itemization flexibility, and updating Virginia’s tax code to reflect changes in the 2017 federal tax reform law.

Last year, Governor Northam and his Democratic allies floated a tax increase to pay for his spending plan, announced earlier this year. Under Northam’s plan, state spending would increase by $2.2 billion, with $1.2 billion of that paid for through higher taxes on 600,000 middle class families. $1.6 billion of Northam’s proposed spending increases would occur after his term expires.

Republicans have said Northam’s tax increase is “dead on arrival.”

“Since last summer, we have been united against Governor Ralph Northam’s plan to pass on higher taxes in order to finance new state spending,” said Speaker Kirk Cox (R-Colonial Heights) in a press release.

“The House Finance Committee acted today to set aside all of the individual income tax revenue from the federal tax cuts to ensure that we provide tax relief to those affected by federal and state tax law changes.”

The legislative package would direct $950 million into a taxpayer relief fund providing assistance to those impacted by the changes.

HB2529, patroned by Delegate Tim Hugo (R-Clifton), allows taxpayers to itemize regardless of how they pay their federal taxes, increases the standard deduction from $3000 to $4000 for individuals, and from $6000 to $8000 for married couples. Under this legislation, additional revenues arising from economic growth and other sources would be directed towards the Commonwealth’s Tax Policy Fund, to be used for tax relief beginning in 2020.

Hugo’s bill advanced on a party line vote, with all Republicans voting in favor of tax relief and all Democrats backing Northam’s call for higher taxes.

“We will provide immediate tax relief to middle-class Virginians,” said Hugo, the chairman of the Republican Caucus. “Our plan will allow taxpayers to itemize their state taxes regardless of how they file their federal return, increase the state standard deduction across the board, and maintain the important state and local tax (SALT) deduction as it exists today. This protects a middle class family that itemizes from what could be roughly a $805 tax increase or providing an additional $115 in tax relief to a family that chooses the standard deduction.”

The legislation also leaves in place the current state and local property tax deduction (SALT), instead of capping it at $10,000, includes a number of technical corrections, removes a drafting error on mortgage interest deductions, and includes the “GILTI” subtraction to prevent a new tax on foreign income for businesses who locate in Virginia.

Republicans have said this tax relief would not cost the state “one penny” and would leave ample revenues available to fund teacher pay raises and other core government services.

The proposal would provide an immediate $575 million in tax relief for the next year, while still allowing for revenue growth. Current projections show the GOP-led effort will result in $37 million in more revenue in the next fiscal year.

Also advanced today was HB2355, introduced by Delegate Chris Jones (R-Suffolk), which advances Virginia’s tax conformity to December 31, 2019, while directing $952 million in revenue from the changes towards the taxpayer relief fund for next year. This provision would capture 100% of the limited-time tax relief made available through the Tax Cuts and Jobs Act (TCJA).

“Though we recognize that we must act on conformity, we are committed to providing tax relief to those impacted by the federal tax changes. My legislation puts all individual tax revenues from conformity in a ‘Taxpayer Relief Fund’ to ensure that it is not used for state spending,” said Jones, who chairs the House Appropriations Committee. “The House budget that will be released on Sunday will not spend one dime of the increased individual tax revenues from the Tax Cuts and Jobs Act and I am committed to providing tax relief for middle-class families.”

Finance committee chairman Lee Ware (R-Powhatan) urged the Commonwealth to act quickly, with the filing deadline approaching.

“With tax filing season upon us, it is important that we act quickly to move forward on conformity,” said Delegate Ware. “By setting aside all revenue from federal tax reform, as Chairman Jones’s bill does, we can ensure that the General Assembly has an opportunity to debate clearly what we should do with this money. Our plan would guarantee tax relief, while Governor Northam uses it to finance $2.2 billion in new state spending.”

Republicans have unified behind the plan, making tax relief and opposition to tax increases a priority for the legislative session.

The issue is proving to be a sharp dividing line between Republicans and Democrats as session rolls on. While the GOP has largely focused on the impacts of the bill for taxpayers, Democrats remain committed the governor’s talking points, denying that the additional $1.2 billion in revenue will be paid by the middle class.

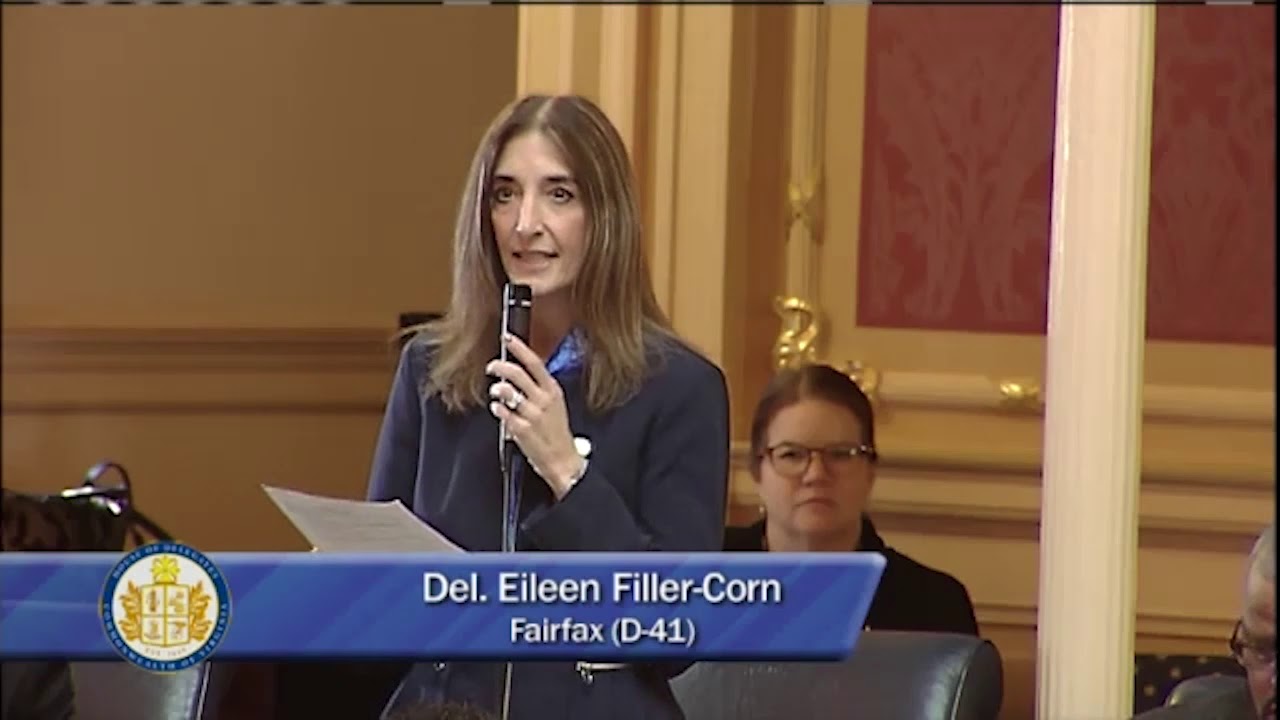

Earlier this month, Democratic minority leader Eileen Filler-Corn wrongly stated that Northam’s proposal was not a tax hike.

“We also heard some incorrect information from the delegate from Fairfax, stating that Governor Northam’s proposal was a tax increase,” said Filler-Corn, in a floor speech to the House of Delegates, referencing Hugo’s legislation.

“There is no tax increase in the governor’s budget plan,” she continued.

Editorial boards have disagreed with her characterization, with the Richmond Times-Dispatch writing, “Gov. Northam’s tax plan wallops the middle class.”

Considering the example of a two-teacher married household, the Times-Dispatch noted, “Assuming a net income of about $80,000 for our two young educators, a back-of-the-envelope calculation of their state income tax liability suggests it would balloon by at least $700 under the Northam plan.”

While the future of the plan remains to be seen, as session continues, Republican legislators said they would continue to fight for tax relief and oppose the higher taxes proposed by Governor Northam.

Virginia’s regular legislative session is scheduled to continue through mid-February. GOP lawmakers said they hoped changes to tax policy would be made in time for filing session, however some lawmakers have hinted that a special session may be forthcoming, if legislators are unable to agree on changes before the General Assembly adjourns.

Less than one week into Virginia’s 2019 legislative session, tax policy issues are quickly becoming the top issue of debate, with Republicans and Democrats in the General Assembly charting starkly different courses.

Earlier today, Republicans announced a unified front behind tax relief legislation offered by Delegate Tim Hugo (R-Clifton), aimed at blocking a hidden $1.2 billion tax hike championed by Democratic Governor Ralph Northam, which the governor used as the basis for a $2.2 billion spending increase contained within his budget.

“Our first and foremost effort is to say no to a hidden tax increase that’s found in the governor’s budget,” said Hugo, speaking on the House floor, following the GOP’s earlier announcement. “Let’s give the money back to the people who are paying the taxes.”

Minutes later, Minority Leader Eileen Filler-Corn (D-Fairfax) took to the House floor, denying that the governor’s budget was built on higher taxes, during a speech touting Democratic priorities, including higher spending and gun control.

“We also heard some incorrect information from the delegate from Fairfax, stating that Governor Northam’s proposal was a tax increase,” said Filler-Corn.

“There is no tax increase in the governor’s budget plan,” she continued.

The Richmond Times-Dispatch editorial board disagreed with that assessment.

In an editorial entitled, “Gov. Northam’s tax plan wallops the middle class,” written last year after Northam released his plan, the Times-Dispatch said:

“Virginia Democrats, led by Gov. Ralph Northam, are preparing to do what Democrats were born to do: raise taxes and spend other people’s money. The opportunity arises thanks to the simplification reforms in last year’s federal tax-cut legislation. This makes the current opportunity to tax and spend especially appealing because state Democrats can use the changing and complex relationship between state and federal tax codes as a cover to ding middle-class Virginians.”

“The Democrats’ media allies are already doing their part by claiming that the state income tax increase the governor and fellow Democrats support will mainly affect ‘the wealthy.’ That’s accurate only if your definition of wealthy extends to, say, a married couple of twenty-something public schoolteachers who just bought their first house. Assuming a net income of about $80,000 for our two young educators, a back-of-the-envelope calculation of their state income tax liability suggests it would balloon by at least $700 under the Northam plan.”

In her speech, Filler-Corn touted several spending priorities paid for by the $1.2 billion in additional revenue referenced by the Times-Dispatch, but said it wasn’t a “tax increase” on the 600,000 Virginians who would pay higher taxes under the governor’s plan, choosing instead to blame President Trump for the refusal of Virginia Democrats to conform the state’s tax code.

In contrast to the unified Republican opposition, Filler-Corn’s Democratic caucus is already showing signs of internal division over the governor’s plan.

In an op-ed published in by the Times-Dispatch, Delegate Dawn Adams (D-Richmond) agreed with the Republican-led effort to allow taxpayers the opportunity to choose between taking the state’s standard deduction and itemizing, regardless of how they file their taxes.

“As a short-term solution, I have drafted legislation that first allows filers to choose whether they want to itemize irrespective of what they do at the federal level,” wrote Adams. “Knowing the backstory gives individuals power to decide how they want to spend their money.”

Adams stopped short, however, of backing the GOP’s proposal to increase Virginia’s standard deduction from $3000 to $4000 for individuals, and from $6000 to $8000 for married couples, a move which would primarily benefit lower and middle income taxpayers.

“‘Doubling Virginia’s standard deduction’ is a bad idea,” she said, in closing.

Another Democratic lawmaker, Delegate Lee Carter (D-Manassas), suggested the governor’s tax increases might be less than he would like, suggesting disagreement within the Democratic caucus.

“So you know I’m looking for ways to get that 5 percent raise entirely on state dollars so localities aren’t feeling that pinch,” said Carter, who self-identifies as “socialist”, during a January 8th interview on the Kojo Nnamdi show.

“But there are some folks, some of my colleagues, who are maybe more skeptical of the idea of the 5 percent raise entirely.”

In contrast to the mixed messages coming from House Democrats, their Republican counterparts are unified against the proposal.

“To be very clear, the governor’s proposal to increase taxes on hard-working Virginians is dead on arrival,” remarked GOP Majority Leader Todd Gilbert (R-Shenandoah), during proceedings on the House floor on Monday.

“We are not going to participate in that,” he said. “We are not going to discuss that. That is a non-starter for this caucus, and we are not going to go along with it, and I just wanted to lay down that marker.”

At the direction of Republican House Speaker Kirk Cox (R-Colonial Heights), Virginia’s House of Delegates will consider Hugo’s bill as a high-priority item early in the session, which is scheduled to last through mid-February.

Cox said addressing the tax issue early was vital to hearing budget amendments, which could not be done until the General Assembly’s money committees had a revenue baseline to work with.

House Republicans announced a unified front behind a plan offering tax relief to 2.7 million low and middle income Virginians. The House GOP plan blocks Governor Northam’s “hidden tax increase” on 600,000 middle class taxpayers.

Helmer: Track every ammunition purchase in a government database to identify mass shooters.