The latest rip from the Biden administration thus far is that inflation is purely caused by Putin’s renewed invasion of the Ukraine. Blame Putin is the new Blame Bush, so we told — and anyone who disagrees with the Volkspartei is instantly branded a Kremlin apologist or worse.

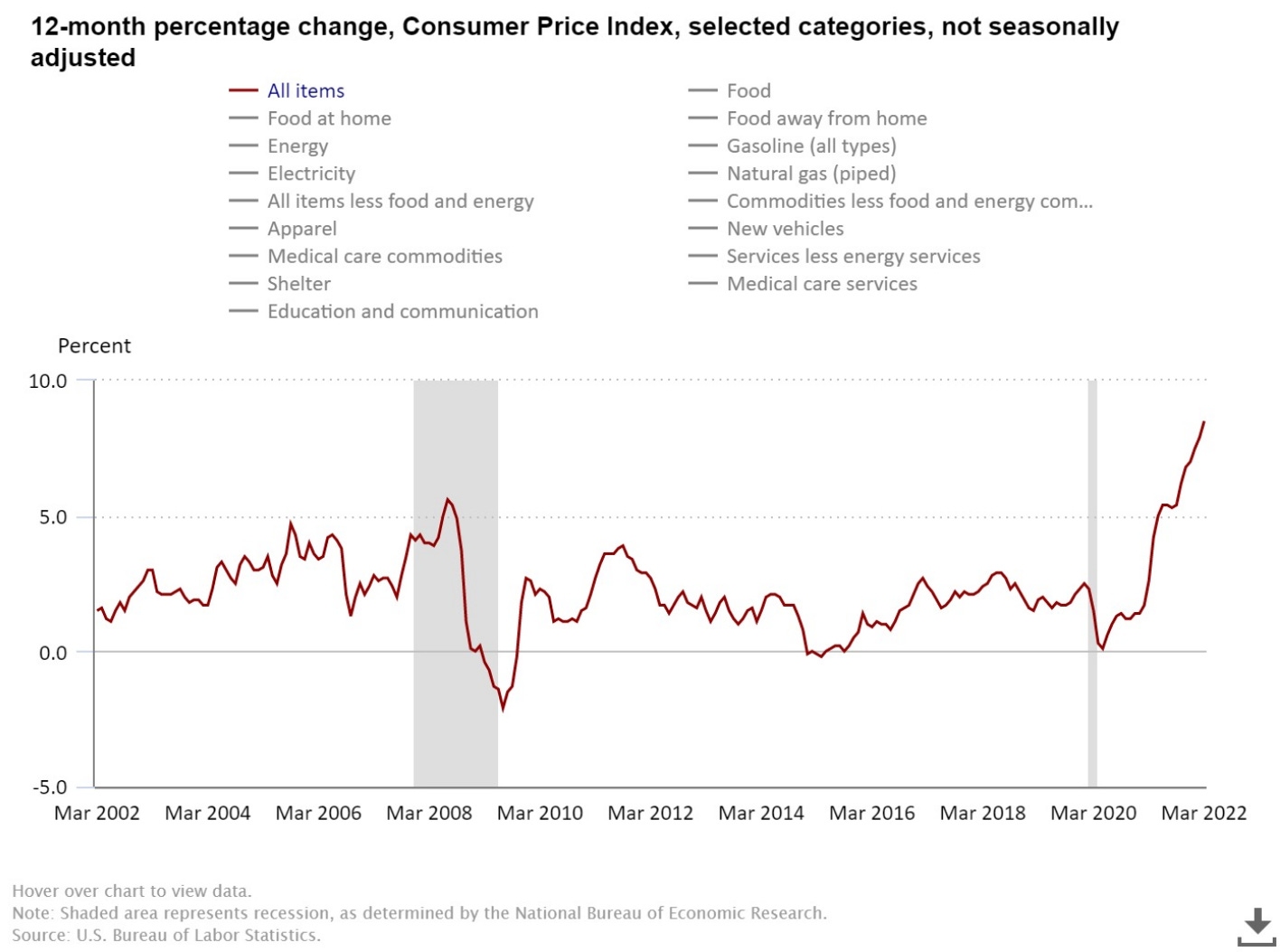

One small problem? The US Department of Labor has some sobering math for you:

YTY inflationary pressures over a 12-month span are showing inflation rates at 8.5%. Coupled with food shortages typically seen in Soviet-era supermarkets and rising energy costs that make so-called green alternatives plausible and one has to wonder whether we are truly facing market forces or something a touch more engineered.

If that sounds rather wild and conspiratorial, then look no further than the editorial pages of today’s WSJ:

Energy prices in the month contributed heavily to the increase, and some of that owes to the ructions in oil markets since the invasion. But so-called core prices, excluding food and energy, rose 6.5% over the last 12 months. Service prices excluding energy, which weren’t supposed to be affected by supply-chain disruptions, were up 0.6% for the month and 4.7% over 12 months.

As the WSJ editors rightly note, President Biden and the Democratic-controlled Congress poured $1,900 billion on pet projects back in March 2021 on top of a $900 billion COVID relief package signed by President Trump in December 2020. Drowning in dollars, the US economy now finds itself in the condition of too much money chasing too few goods.

Yet the trendlines for this did not start in March 2022 with the renewal of hostilities in Eastern Europe.

Yet as the headlines hint and the WSJ op-ed implies, the solution will be to restrict the supply of dollars — not by limiting state and federal spending, but by hurting American working class families:

Still, the overall price news is terrible for American workers and consumers. The March surge means that real wages fell 0.8%, or a decline of 2.7% in the last year. (See the nearby chart.) Real average weekly earnings fell a striking $4.26 in March alone, and they’ve fallen nearly $18 during the Biden Presidency. If you want to know why Americans are sour about the economy even as jobs are plentiful, this is it. Their real wages are falling while the prices of everyday goods and services are rising fast. The average worker Democrats invoke when they demand more federal spending is getting crushed by the inflationary consequences of too much federal spending.

The Federal Reserve’s solution?

Increase interest rates across the board, though only to 2% in order to stave off a recession. Yet even if interest rates go up to 6.5% in order to combat inflation, with jobs plentiful and American workers refusing to re-enter the workforce, the solution — and this is a fast track solution — would simply be to add more workers to the workforce. . .

Yet as the UK Economist notes, this solution in an environment where “bad jobs” are sloughing off in favor of better paying ones with quality employees may simply signal a shift from the old cubicle-dwelling model to hybrid work, where skilled jobs are paying more and more to attract skilled labor:

It is likely, therefore, that in America and elsewhere labour markets will have to be cooled the old-fashioned way: by central banks raising interest rates, making it a little more attractive to save than spend and choking off demand for labour. The Fed has already increased rates by 0.25 percentage points, and is expected to do so by a total of 2.5 points this year. America may prove an example of what happens when policymakers respond to a labour market that has become dangerously hot.

In short, state and federal spending is so hot that the economy isn’t able to catch up. The conflict in the Ukraine may be driving up both energy and food prices on the periphery, but the responsibility for 8.5% inflation — numbers not seen since the Jimmy Carter era — remains entirely with Joe Biden’s love affair with government spending.

Of course, for anyone with a 401(k) or pension? This means that your nest egg is now worth a solid 10% less than what it was two years ago — give or take whatever you are putting back in on your investments (and it has been a rocky year).

Which means that American corporations are looking to maintain those 8-10% quarterly earning reports for John and Jane Q. Investor — approximately half of the American population, though only about 5% of Americans own more than the $40,000 median of the other 45% who have invested anything at all; the top 10% of income earners owning 70% of the US stock market.

You can see where this goes when it comes to an investor class vs. the working class, or where the decision makers who are well padded simply cannot have a conversation much less envision what a 8.5% pay cut does to a family already working hard to make ends meet with zero cushion at all.