Under the tutelage of Speaker Kirk Cox (R-Colonial Heights), Republicans in the Virginia House of Delegates have accomplished a multitude of legislative items on the conservative agenda under the mantra of “Practical Solutions to Everyday Issues.” During the first half of the 2018 session of the General Assembly, House Republicans announced several major bipartisan agreements. Furthermore, they have thwarted higher taxes on millennials, created ways in which Virginians can better seek jobs, and are in the beginnings of crafting a balanced state budget.

“At the start of this General Assembly session I encouraged the General Assembly to renew its commitment to governing,” said Speaker Cox, according to a press release on Wednesday. “I am proud of the work we have accomplished, whether it was advancing practical solutions to everyday issues, achieving bipartisan compromises on major issues, defeating tax increases, and beginning to work on the budget. The House of Delegates had a very productive and successful first 30 days of the General Assembly session. We are confident we can replicate this success over the second half of the session,” he added.

The House Republican leadership declared their agenda in November to focus on key priorities for Virginians and garner broad bipartisan support. Among these priority issues are many that involve the education system in the commonwealth. The General Assembly has worked to pass legislation in solving the teacher shortage in public schools, providing security for students and their information, and ensuring that students who complete dual enrollment courses in high school will receive the college credit they are due, thus cutting the cost of higher education.

Among one of the first actions by Republicans in 2018 was the introduction of House Bill 1. Sponsored by Delegate Tony Wilt (R-Rockingham), the bill was in relation to those who were worried about the way their personal information was being handled. “Protecting personal student information is more important than furthering any political campaign, political activist group, or marketing effort,” he said.

The bill designates a student or the parent or legal guardian as the sole owner of the information, not the school. According to the bill, “a school shall not release the address, phone number, or email address of a student unless the parent, legal guardian, or eligible student has affirmatively consented in writing to the designation of any or all of such information as directory information.”

House Bill 2, introduced by Delegate Dickie Bell (R-Staunton), will allow a spouse of any member of the armed forces, who has a valid out-of-state teaching license, to enjoy licensure reciprocity in Virginia. This means that a spouse of a member of the armed forces in Virginia, who is currently a licensed teacher in another state, could seamlessly transition into a Virginia classroom.

“One of our first and foremost responsibilities to improve our education system must be ensuring we have enough teachers to limit class sizes and allow for all students to receive the best education possible.” said Delegate Bell. The veteran and former teacher explained that Virginia should be committed to being the most military-friendly state while fixing the teacher shortage in public classrooms. “We should be welcoming our military members with open arms by helping them cut through the bureaucratic red tape that keeps them from continuing to educate our children,” he added.

In reference to dual enrollment courses, House Education Committee Chairman Steven Landes (R-Augusta) carried House Bill 3 onto the floor. The legislation will require the State Council of Higher Education (SCHEV) to establish quality standards for dual enrollment courses, including standards for instructors, materials, and content. The bill will create “Universal Transfer Courses” that meet these criteria. The solution allows students to save vital time and money by ensuring dual enrollment programs are working by allowing students to earn college credits in high school, applying those credits to a 2-year or 4-year degree.

“I appreciate my colleagues support in doing what we can to rein in the cost of higher education because it’s no secret college is expensive,” said Delegate Landes. “There should be less secrecy surrounding what colleges will and won’t accept as transfer credits,” he stated.

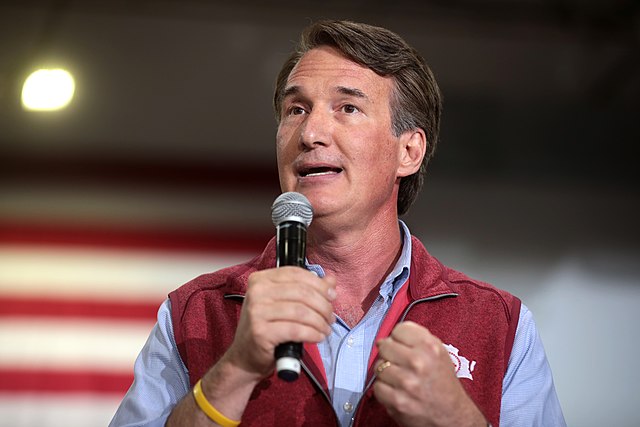

Republicans in the House also reached across the political aisle with Democrats and Governor Northam to advance legislation on regulatory reform and criminal justice reform. The bipartisan compromise on regulatory reform will eliminate 25 percent of state regulations over the next three years. As well, to renegotiate criminal justice laws in Virginia, the Republican-led House agreed to raise the felony theft threshold from $200 to $500 in exchange for governor Northam’s support for stricter restitution enforcement laws.

Last week, according to a press please from the office of Speaker Cox, “the compromise marks a stark difference between Washington and Richmond…leaders in Richmond identify problems and work together to achieve a bipartisan solution.” The regulatory reform mirrors what President Donald Trump has sought to accomplish in Washington to slash burdensome regulations before crafting new ones.

House Bill 883, introduced by Delegate Michael Webert (R-Fauquier) will allow the reduction of state regulations by 25 percent through 2021. The bill also provides for the Department of Planning and Budget to establish an initial regulation baseline budget consisting of the total number of regulations enforced by executive branch state agencies. “Between October 1, 2018, and July 1, 2021, no new regulation may be approved by the Department unless the proposing agency also submits two or more of its current regulations to be replaced or repealed,” according to the legislation.

In raising the felony theft threshold, Senate Bill 21, introduced by Senator Scott Surovell (D-Fairfax), was forwarded to the Republican-led Committee for Courts for Justice. After the Republican House committee rejected a push by Governor Northam to raise the limit to $1,000, a compromise was agreed upon at $500.

“Washington should take note,” said House Majority Leader Todd Gilbert (R-Shenandoah). “We have led by example, reaching bipartisan agreements on important issues and passing legislation that will have a meaningful impact on the lives of everyday Virginians. The Speaker set a clear tone from day one and the House has lived up to its commitment to lead and govern the Commonwealth in a bipartisan fashion,” he opined. The “Virginia Way” has held well after a contentious election cycle in 2017. Although there is an immense amount of political animosity between the parties in Washington, the Virginia legislature can accomplish its agenda without quibbling about differences on party lines.

Another accomplishment from the Republican House was addressing transportation congestion and the aging Metro system. In true conservative fashion, this was done without raising taxes on Virginians. House Bill 1539, introduced by Caucus Chairman Tim Hugo (R-Fairfax), amends the Washington Metropolitan Area Transit Authority (WMATA) compact of 1966. The legislation creates a three-person interim advisory commission that is required to advise on recommendations. According to the bill, $100 million will be appropriated from the General Fund to assist in maintenance and improvements on the Metro rail lines and its facilities.

“We understand how important Metro is to Virginia’s economy, specifically the Northern Virginia business community,” said Speaker Cox in press release. “It’s a core asset to the region, generates over $600 million in tax revenue, and is responsible for the continued economic success of the region, but the system needs dire reforms,” he added.

Legislation passed by House Republicans has also included adoption reform to help children find loving families in a swifter manner “Family is the bedrock of our society. Easing adoption regulations puts families first and help more children find loving parents,” according to a release from the Virginia House GOP.

The Kinship Guardianship Assistance Program outlined in House Bill 1333, introduced by Emily Brewer (R-Suffolk) helps the relationship between foster youth and their caregivers. The bill establishes a new path to permanency for foster youth who have resided in foster homes with relative caregivers for at least six months.

In addition to the program, Delegate Brewer sponsored House Bill 241, lowering the amount of time a child must reside with a close relative. According to the bill, the length of time is lessened from three years to two years, that a child must live with a close family member before adoption proceedings can begin.

Job creation and job training was also on the docket for the General Assembly in 2018. House Republicans were adamant that workers need to get the training they deserve to find a good-paying job. Delegate Hugo also sponsored House Bill 1233 which bolsters the apprenticeship program in Virginia. The legislation allows more apprentices to get more on–the–job–training by prohibiting the Apprenticeship Council from adopting standards for apprenticeship agreements governing the numeric ratio of journeymen to apprentices that require more than one journeyman for two apprentices.

House Republicans also stood up against Democrats to protect taxpayers from significant tax hikes. The Democratic delegation introduced several tax increases that disproportionately affected millennials. The “Netflix tax” was one of the ways the liberal faction of the General Assembly attempted to impede further on the lives of the “cord cutting” generation.

House Bill 1051, introduced by Delegate Vivian Watts (D-Fairfax), was set to apply new communications sales and use taxes to streaming services millennials love for audio and visual data, as well as prepaid calling services. As stated in the language of the legislation, “The bill also clarifies that the tax applies to communications services regardless of whether customers are charged a subscription fee, a periodic fee, or an actual usage fee.” This new legislation was set to tax things like Netflix, Pandora, and Hulu, all streaming services.

A separate proposal from Senator Dick Saslaw (D-Springfield) would have taxed Uber and Lyft. In opposition, Delegate Hugo said, “Our constituents sent us here to pass legislation that will improve their everyday lives, not take more of their hard-earned money for unnecessary government spending.” While Virginia Democrats enjoyed a clear electoral favor from millennials, they may not have been the case if they were actually kept abreast of their proposed legislation. Many Republicans stood up in defiance against Democrats and their love affair with taxes.

Before the end of the session, the House of Delegates fully intends to pass a structurally balanced budget on time. Conservative budgeting is the hallmark of responsible governing, according to the Virginia House GOP. “Our aim is to always be good stewards of taxpayer dollars. Achieving this goal is contingent on setting priorities and making tough decisions,” they explained.

The budget, which will be released on Sunday, will make sensible investments in supporting K-12 education, increasing the reserve fund, funding the state medicaid program, and staving off an unnecessary government shutdown.

House Bill 763, introduced by Delegate Chris Jones (R-Suffolk), establishes a Revenue Reserve Fund to offset shortfalls in the budget. According to the bill, future shortfalls in the state budget also, “cannot be addressed by the Rainy Day Fund.”

“Under the direction of Chairman Jones, and the hard working members of the House Appropriations Committee, we are finalizing the House’s proposal for the new, two-year state budget,” said House Majority Whip Nick Rush (R-Montgomery) in the release. “We are crafting a responsible, balanced budget that spends taxpayer dollars with strategic care while making smart investments in the core functions of state government.”

House Republicans have been committed to keeping taxes low so Virginia businesses can be competitive and Virginia families can keep more of their money in their pocket. In all, Republicans have voted down over $770 million in new taxes on hardworking Virginians from Democrats in the General Assembly.