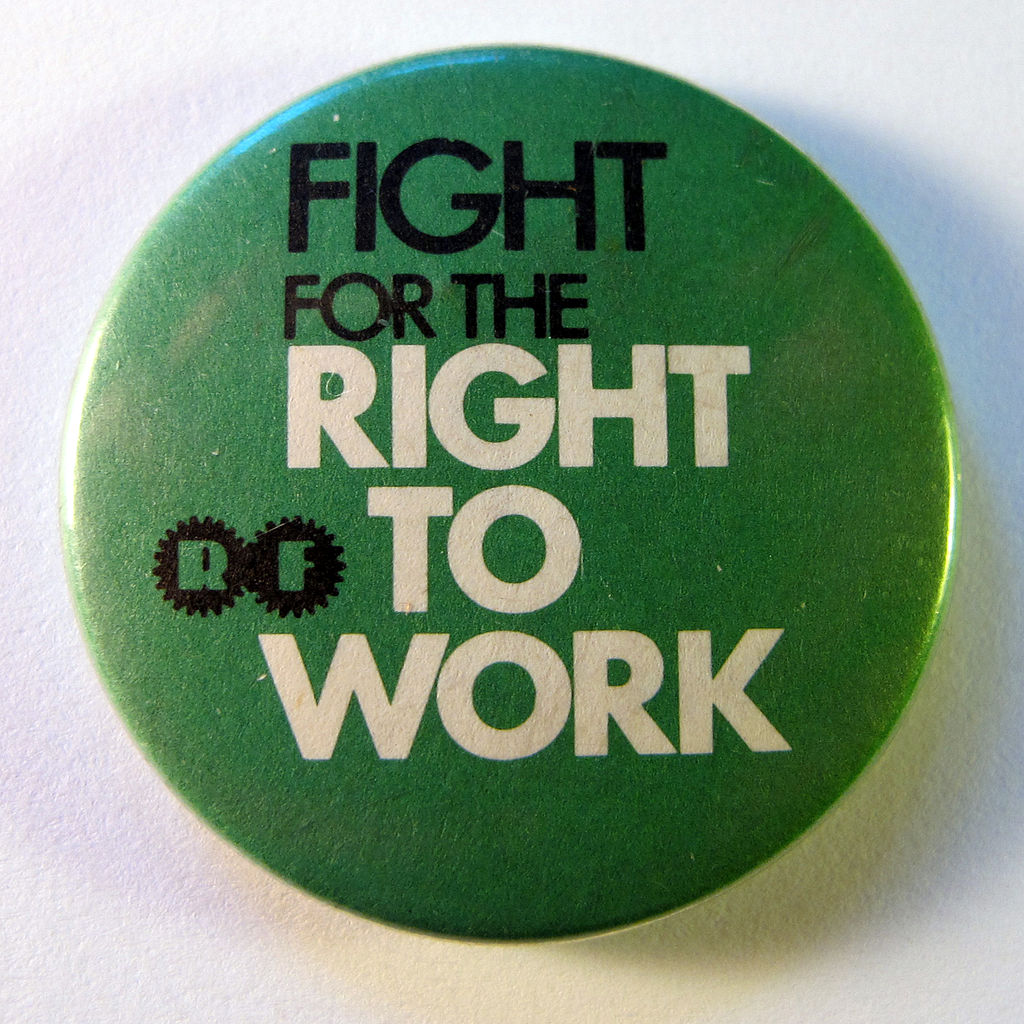

The Supreme Court’s decision in Janus v. AFSCME shows that right-to-work laws are not inherently union busting, but create an atmosphere wherein a union does not have to exist when workers are given freedom of choice.

Virginia's Public Square

Virginia's Public Square

The Supreme Court’s decision in Janus v. AFSCME shows that right-to-work laws are not inherently union busting, but create an atmosphere wherein a union does not have to exist when workers are given freedom of choice.

Democratic lawmakers were advised to avoid answering direct questions about sexual assault allegations against Justin Fairfax, and whether they believe his accusers, according to an email leaked by a Democratic legislator to the New York Times.

As Republicans remain unified behind tax relief, Democrats remain committed to emptying the pockets of middle-class Virginians.

54% of Democratic lawmakers sponsored Kathy Tran’s late term abortion bill, in addition to Governor Ralph Northam, Lt. Governor Justin Fairfax, and Attorney General Mark Herring. The bill is supported by a majority of Virginia Democrats. Here’s the list.

Giant Food is introducing labor-saving robots to all 172 grocery stores, as Virginia lawmakers consider bills repealing the state’s Right to Work law and doubling the minimum wage. Should lawmakers raise labor costs, more stores could invest further in automation and artificial intelligence.

Less than one week into Virginia’s 2019 legislative session, tax policy issues are quickly becoming the top issue of debate, with Republicans and Democrats in the General Assembly charting starkly different courses.

Earlier today, Republicans announced a unified front behind tax relief legislation offered by Delegate Tim Hugo (R-Clifton), aimed at blocking a hidden $1.2 billion tax hike championed by Democratic Governor Ralph Northam, which the governor used as the basis for a $2.2 billion spending increase contained within his budget.

“Our first and foremost effort is to say no to a hidden tax increase that’s found in the governor’s budget,” said Hugo, speaking on the House floor, following the GOP’s earlier announcement. “Let’s give the money back to the people who are paying the taxes.”

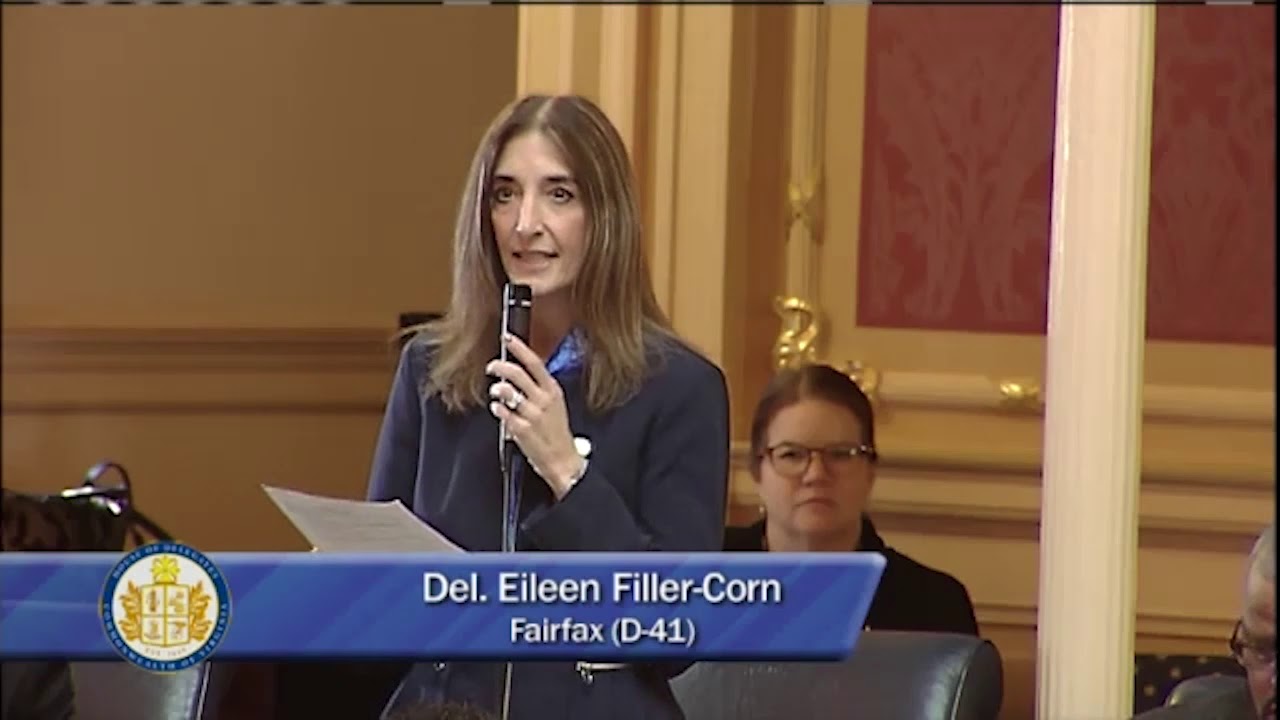

Minutes later, Minority Leader Eileen Filler-Corn (D-Fairfax) took to the House floor, denying that the governor’s budget was built on higher taxes, during a speech touting Democratic priorities, including higher spending and gun control.

“We also heard some incorrect information from the delegate from Fairfax, stating that Governor Northam’s proposal was a tax increase,” said Filler-Corn.

“There is no tax increase in the governor’s budget plan,” she continued.

The Richmond Times-Dispatch editorial board disagreed with that assessment.

In an editorial entitled, “Gov. Northam’s tax plan wallops the middle class,” written last year after Northam released his plan, the Times-Dispatch said:

“Virginia Democrats, led by Gov. Ralph Northam, are preparing to do what Democrats were born to do: raise taxes and spend other people’s money. The opportunity arises thanks to the simplification reforms in last year’s federal tax-cut legislation. This makes the current opportunity to tax and spend especially appealing because state Democrats can use the changing and complex relationship between state and federal tax codes as a cover to ding middle-class Virginians.”

“The Democrats’ media allies are already doing their part by claiming that the state income tax increase the governor and fellow Democrats support will mainly affect ‘the wealthy.’ That’s accurate only if your definition of wealthy extends to, say, a married couple of twenty-something public schoolteachers who just bought their first house. Assuming a net income of about $80,000 for our two young educators, a back-of-the-envelope calculation of their state income tax liability suggests it would balloon by at least $700 under the Northam plan.”

In her speech, Filler-Corn touted several spending priorities paid for by the $1.2 billion in additional revenue referenced by the Times-Dispatch, but said it wasn’t a “tax increase” on the 600,000 Virginians who would pay higher taxes under the governor’s plan, choosing instead to blame President Trump for the refusal of Virginia Democrats to conform the state’s tax code.

In contrast to the unified Republican opposition, Filler-Corn’s Democratic caucus is already showing signs of internal division over the governor’s plan.

In an op-ed published in by the Times-Dispatch, Delegate Dawn Adams (D-Richmond) agreed with the Republican-led effort to allow taxpayers the opportunity to choose between taking the state’s standard deduction and itemizing, regardless of how they file their taxes.

“As a short-term solution, I have drafted legislation that first allows filers to choose whether they want to itemize irrespective of what they do at the federal level,” wrote Adams. “Knowing the backstory gives individuals power to decide how they want to spend their money.”

Adams stopped short, however, of backing the GOP’s proposal to increase Virginia’s standard deduction from $3000 to $4000 for individuals, and from $6000 to $8000 for married couples, a move which would primarily benefit lower and middle income taxpayers.

“‘Doubling Virginia’s standard deduction’ is a bad idea,” she said, in closing.

Another Democratic lawmaker, Delegate Lee Carter (D-Manassas), suggested the governor’s tax increases might be less than he would like, suggesting disagreement within the Democratic caucus.

“So you know I’m looking for ways to get that 5 percent raise entirely on state dollars so localities aren’t feeling that pinch,” said Carter, who self-identifies as “socialist”, during a January 8th interview on the Kojo Nnamdi show.

“But there are some folks, some of my colleagues, who are maybe more skeptical of the idea of the 5 percent raise entirely.”

In contrast to the mixed messages coming from House Democrats, their Republican counterparts are unified against the proposal.

“To be very clear, the governor’s proposal to increase taxes on hard-working Virginians is dead on arrival,” remarked GOP Majority Leader Todd Gilbert (R-Shenandoah), during proceedings on the House floor on Monday.

“We are not going to participate in that,” he said. “We are not going to discuss that. That is a non-starter for this caucus, and we are not going to go along with it, and I just wanted to lay down that marker.”

At the direction of Republican House Speaker Kirk Cox (R-Colonial Heights), Virginia’s House of Delegates will consider Hugo’s bill as a high-priority item early in the session, which is scheduled to last through mid-February.

Cox said addressing the tax issue early was vital to hearing budget amendments, which could not be done until the General Assembly’s money committees had a revenue baseline to work with.

House Republicans announced a unified front behind a plan offering tax relief to 2.7 million low and middle income Virginians. The House GOP plan blocks Governor Northam’s “hidden tax increase” on 600,000 middle class taxpayers.

Union-friendly “Democratic socialist” Lee Carter said he hopes the threat of unions closing down schools will lead to more spending. Carter, who also introduced a bill repealing Virginia’s Right to Work law, authored legislation allowing government employees to strike and walk off the job.

Legislators will vote on repealing Right to Work during the 2019 session, beginning next month. Carter’s bill is one of several union-friendly measures lawmakers will consider.

A seasonal worker’s $500 paycheck was reduced to $14.52 after mandatory union dues deductions in a non-Right to Work state. Seasonal employees in Virginia would face the same predicament, if Democrats succeed in repealing Virginia’s Right to Work law.