GOP mass meeting scheduled to take place at the Fairfax Christian School at 22870 Pacific Boulevard in Dulles at 9:00 a.m. on Saturday, January 19 to nominate a candidate for the 86th House District special election on February 19.

Virginia's Public Square

Virginia's Public Square

Featured posts

GOP mass meeting scheduled to take place at the Fairfax Christian School at 22870 Pacific Boulevard in Dulles at 9:00 a.m. on Saturday, January 19 to nominate a candidate for the 86th House District special election on February 19.

House Republicans outraised Democrats by $1.8 million and have $2.2 million more in the bank. GOP leaders say they’re well-positioned for November.

A lawsuit against the Commonwealth is now moving forward as the Lee County School division is challenging Attorney General Mark Herring’s legal opinion on arming teachers to protect students.

Less than one week into Virginia’s 2019 legislative session, tax policy issues are quickly becoming the top issue of debate, with Republicans and Democrats in the General Assembly charting starkly different courses.

Earlier today, Republicans announced a unified front behind tax relief legislation offered by Delegate Tim Hugo (R-Clifton), aimed at blocking a hidden $1.2 billion tax hike championed by Democratic Governor Ralph Northam, which the governor used as the basis for a $2.2 billion spending increase contained within his budget.

“Our first and foremost effort is to say no to a hidden tax increase that’s found in the governor’s budget,” said Hugo, speaking on the House floor, following the GOP’s earlier announcement. “Let’s give the money back to the people who are paying the taxes.”

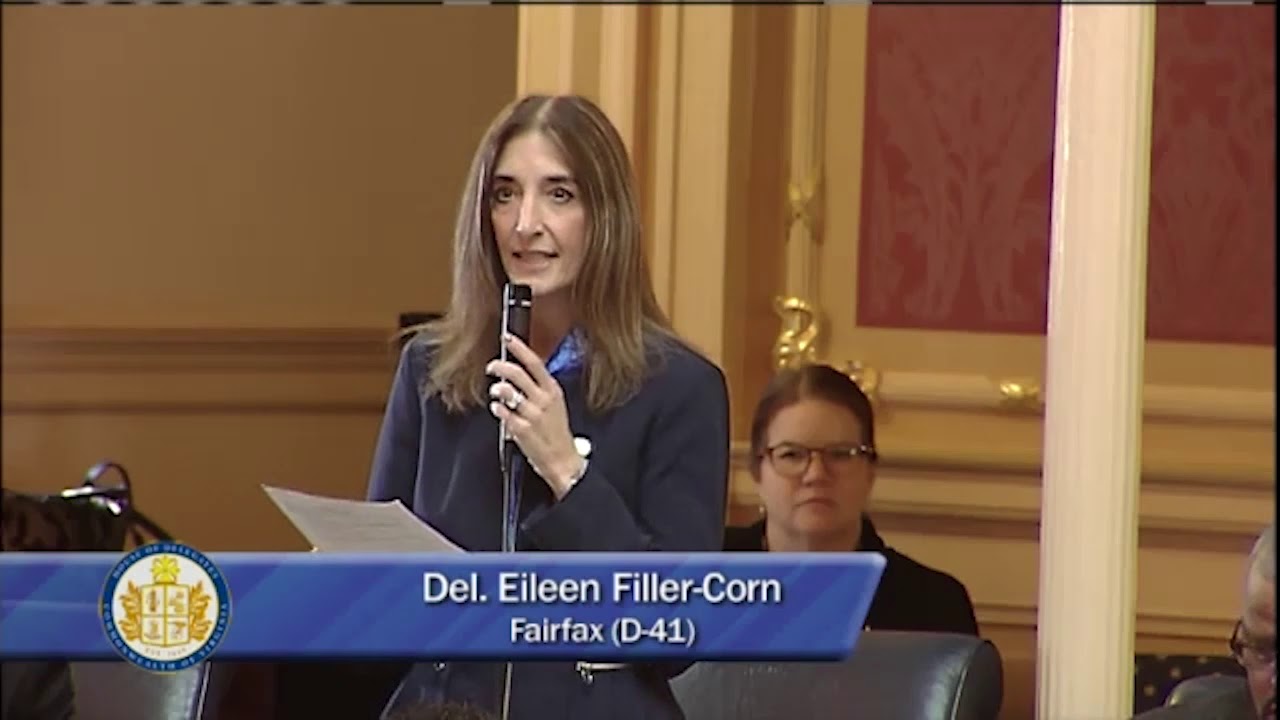

Minutes later, Minority Leader Eileen Filler-Corn (D-Fairfax) took to the House floor, denying that the governor’s budget was built on higher taxes, during a speech touting Democratic priorities, including higher spending and gun control.

“We also heard some incorrect information from the delegate from Fairfax, stating that Governor Northam’s proposal was a tax increase,” said Filler-Corn.

“There is no tax increase in the governor’s budget plan,” she continued.

The Richmond Times-Dispatch editorial board disagreed with that assessment.

In an editorial entitled, “Gov. Northam’s tax plan wallops the middle class,” written last year after Northam released his plan, the Times-Dispatch said:

“Virginia Democrats, led by Gov. Ralph Northam, are preparing to do what Democrats were born to do: raise taxes and spend other people’s money. The opportunity arises thanks to the simplification reforms in last year’s federal tax-cut legislation. This makes the current opportunity to tax and spend especially appealing because state Democrats can use the changing and complex relationship between state and federal tax codes as a cover to ding middle-class Virginians.”

“The Democrats’ media allies are already doing their part by claiming that the state income tax increase the governor and fellow Democrats support will mainly affect ‘the wealthy.’ That’s accurate only if your definition of wealthy extends to, say, a married couple of twenty-something public schoolteachers who just bought their first house. Assuming a net income of about $80,000 for our two young educators, a back-of-the-envelope calculation of their state income tax liability suggests it would balloon by at least $700 under the Northam plan.”

In her speech, Filler-Corn touted several spending priorities paid for by the $1.2 billion in additional revenue referenced by the Times-Dispatch, but said it wasn’t a “tax increase” on the 600,000 Virginians who would pay higher taxes under the governor’s plan, choosing instead to blame President Trump for the refusal of Virginia Democrats to conform the state’s tax code.

In contrast to the unified Republican opposition, Filler-Corn’s Democratic caucus is already showing signs of internal division over the governor’s plan.

In an op-ed published in by the Times-Dispatch, Delegate Dawn Adams (D-Richmond) agreed with the Republican-led effort to allow taxpayers the opportunity to choose between taking the state’s standard deduction and itemizing, regardless of how they file their taxes.

“As a short-term solution, I have drafted legislation that first allows filers to choose whether they want to itemize irrespective of what they do at the federal level,” wrote Adams. “Knowing the backstory gives individuals power to decide how they want to spend their money.”

Adams stopped short, however, of backing the GOP’s proposal to increase Virginia’s standard deduction from $3000 to $4000 for individuals, and from $6000 to $8000 for married couples, a move which would primarily benefit lower and middle income taxpayers.

“‘Doubling Virginia’s standard deduction’ is a bad idea,” she said, in closing.

Another Democratic lawmaker, Delegate Lee Carter (D-Manassas), suggested the governor’s tax increases might be less than he would like, suggesting disagreement within the Democratic caucus.

“So you know I’m looking for ways to get that 5 percent raise entirely on state dollars so localities aren’t feeling that pinch,” said Carter, who self-identifies as “socialist”, during a January 8th interview on the Kojo Nnamdi show.

“But there are some folks, some of my colleagues, who are maybe more skeptical of the idea of the 5 percent raise entirely.”

In contrast to the mixed messages coming from House Democrats, their Republican counterparts are unified against the proposal.

“To be very clear, the governor’s proposal to increase taxes on hard-working Virginians is dead on arrival,” remarked GOP Majority Leader Todd Gilbert (R-Shenandoah), during proceedings on the House floor on Monday.

“We are not going to participate in that,” he said. “We are not going to discuss that. That is a non-starter for this caucus, and we are not going to go along with it, and I just wanted to lay down that marker.”

At the direction of Republican House Speaker Kirk Cox (R-Colonial Heights), Virginia’s House of Delegates will consider Hugo’s bill as a high-priority item early in the session, which is scheduled to last through mid-February.

Cox said addressing the tax issue early was vital to hearing budget amendments, which could not be done until the General Assembly’s money committees had a revenue baseline to work with.

House Republicans announced a unified front behind a plan offering tax relief to 2.7 million low and middle income Virginians. The House GOP plan blocks Governor Northam’s “hidden tax increase” on 600,000 middle class taxpayers.

The measure not only drew ire from Democrats, it sparked an angry confrontation between advocates of the bill and the Republican state senator who sponsored it.

Virginia is close to becoming the 38th state to pass the Equal Rights Amendment, but the legislation now faces a House of Delegates where it has died five times in the past eight years.

The Senate confirmation hearing for William Barr, President Donald Trump’s new pick for attorney general, began Tuesday morning, seemingly less contentious than the hearings that dominated autumn 2018 with Supreme Court Justice Brett Kavanaugh. Barr served as the 77th Attorney General under the late former President George H. W. Bush from 1991 to 1993.

The Reagan-era policy staffer was known as a strong defender of presidential power and aggressive actions on terrorism and drug-trafficking. Regardless, during his 1991 confirmation hearing he received a good reception from both Republicans and Democrats.

One of the biggest issues surrounding the confirmation of Barr is how he will handle White House Special Counsel Robert Mueller’s investigation into Russian collusion into the 2016 presidential election. Many on the Senate Judiciary Committee prompted Barr to reveal if he would act to protect the president if the eventual release of the report would incriminate the commander in chief.

With talk of the upcoming departure of Deputy Attorney General Rod Rosenstein, who has been at odds with President Trump in the recent past, Barr explained that he has nothing to do with the decision. Although Barr would be allowed to choose his deputy for the Department of Justice (DOJ), he reiterated that he has asked Rosenstein to stay on for “a period” if he is confirmed.

Barr also answered questions on whether he would allow Trump to direct him in the Russia investigation, after ousted Attorney General Jeff Sessions recused himself in the weeks after the president’s inauguration – an issue that began the tumultuous relationship between the two.

“I will not be bullied into doing anything I think is wrong,” Barr said.

Recently, however, Senator Kamala Harris (D-CA), a widely-speculated 2020 Democratic presidential candidate, believes Barr should recuse himself from overseeing Mueller’s investigation.

On Tuesday, senators Richard Blumenthal (D-MA) and Dianne Feinstein (D-CA) charged that Barr that he must act as a fully independent attorney general, regardless of the wishes of the president, who has said that he does not want a DOJ head that will recuse himself. Furthermore, Feinstein prodded Barr to commit to not interfering in the Russia probe.

“The special counsel’s investigation is set by his charter and by the regulations, and I will ensure those are maintained,” Barr said, adding that he will not terminate the investigation “without good cause.” He also said the special counsel “is not involved” in a witch hunt.

Although Senate Judiciary Chairman Lindsey Graham (R-SC) said the process to confirm and the subsequent responsibilities of Trump’s pick for attorney general “will be challenging,” he expressed confidence in Barr during the questioning insofar as Mueller’s investigation is concerned. Barr said Mueller will be allowed to continue the investigation, making the results public, consistent with federal regulations.

“I believe it is in the best interest of everyone…Bob will be allowed to finish his work,” he said, who also has a friendly relationship with the special counsel.

As the confirmation hearings continue, Barr will also be grilled on presidential powers, immigration enforcement, abortion and the validity of Roe v. Wade (1973), the handling of enemy combatants and the constitutionality of torture, protections for journalists, and his past actions in previous administrations.

If Barr becomes the 85th attorney general, he will be the first to repeat the position since its inception in 1789. He will replace acting-Attorney General Matt Whitaker who was thrust into the position following his tenure as chief of staff to former Attorney General Sessions after a two-year, mostly bad-tempered relationship with President Trump.

Del. Bob Thomas’ bill would eliminate the age cap for coverage of ASD by health insurance plans. Current law requires coverage from ages two through ten. Thomas says its time for families to have access to life-changing treatments.

The move by Senate Majority Leader Tommy Norment (R-James City County) and Senator Frank Wagner (R-Virginia Beach) could be an election-savvy effort to set up all 19 Senate Democrats to vote on a bill that is widely unpopular in the small business community.