As lawmakers prepare to head to Richmond next week, House Republicans unveiled legislation pushing back on the higher taxes included in Governor Ralph Northam’s budget, vowing to fight Democratic attempts to raise $1.2 billion in new revenue from more than 600,000 taxpayers, proposing instead a plan which would reduce the state tax burden for 2.7 middle and low-income filers through an expansion of the standard deduction.

“Today is an important day as we introduce a plan that does exactly what we have all promised our constituents we would do while serving them in Richmond,” said Speaker Kirk Cox (R-Colonial Heights). “We are offering a responsible plan to stop Governor Ralph Northam’s middle-class tax hike and provide targeted tax relief to middle and low income Virginians while protecting the state’s AAA bond rating.”

Under the plan, unveiled Friday by Speaker Cox and delegates Tim Hugo (R-Clifton), Lee Ware (R-Powhatan), and Chris Jones (R-Suffolk), who chair key House committees which will hear the measure, each filer could choose to itemize their state taxes or opt for the standard deduction, depending on their individual tax situation. Current law requires filers who take the standard deduction federally to also claim it on their state return.

The proposal, Republicans said, would protect the value of the standard deduction in Virginia, offering tax relief to middle and low-income filers by increasing Virginia’s standard deduction from $3000 to $4000 for individuals, and from $6000 to $8000 for married couples, while also encouraging tax simplification by reducing the number of taxpayers who itemize.

This increase in the standard deduction would offer tax relief to 2.7 million middle and low-income Virginians, not just the 600,000 who would pay more under the governor’s budget.

According to IRS statistics, only 6.5% of filers with incomes over $200,000 opt for the standard deduction.

Earlier this year, Northam announced his opposition to a routine, revenue-neutral tax conformity measure, using $1.2 billion in new revenue anticipated from middle class filers to fund $2.2 billion in additional state spending, $1.6 billion of which is recurring spending after he leaves office.

Republicans have called Northam’s revenue proposal, which omits the technical fix, a “hidden tax increase.”

The issue with the standard deduction began following the passage of federal tax reform in 2017, which nearly doubled the standard deduction, as a means of simplifying taxes for middle class families and offering additional tax relief to mid-income filers.

Under the governor’s proposal, a married, home-owning couple each making $55,000 per year would pay $805 more in Virginia income taxes, depending on their deductions. Under the Republican plan, this family would receive $115 in tax relief — nearly a thousand dollar contrast between the two plans.

For example, a married couple filing jointly who could claim $15,000 in deductions in 2017 would be better off itemizing under the old rules, as the federal standard deduction for that year was only $12,700. Under tax reform, which raised the standard deduction for married couples filing jointly to $24,000, they would be better off by not itemizing.

However, under Northam’s proposal, this couple would face higher state taxes, as they would be prohibited from continuing to itemize on their Virginia return.

By contrast, under Hugo’s bill, Virginia taxpayers would be allowed to choose whether to take the standard deduction or itemize on their state return, shielding filers from paying the higher taxes which underpin Northam’s budget, which does not allow taxpayers to choose how they file.

“Our proposal keeps more money in the pockets of Virginians without costing the state one penny,” said Hugo, who will formally introduce the legislation next week. “Even after providing this tax relief, the state will have more money for teachers, transportation and other key services than it did last year. Our plan says ‘no’ to a tax hike on the middle class and ‘yes’ to cutting taxes for all Virginians.”

For homeowners, the plan would also preserve the existing law for state and local tax deductions, also known as SALT. The proposal would not cap the SALT deduction. Additionally, key itemizations like the mortgage interest deduction would be preserved.

The Republican plan also includes a one-time deduction available in 2019, allowing taxpayers to offset higher taxes paid in 2018 as a result of implementation timing.

Finally, the plan would protect Virginia’s AAA bond rating by extending the changes through 2024, in conjunction with federal law. Under US Senate rules, the budget reconciliation process used to pass federal tax cuts for the middle class limited the length of the tax cuts, requiring separate legislation to make them permanent, which Congressional Republicans have vowed to pass.

“The plan we are offering will responsibly protect the state’s existing revenue streams and AAA bond rating while also fully implementing the federal tax cuts for middle-class families and providing broad tax relief to low-income Virginians,” said Jones, Chair of the House Appropriations Committee. “The federal tax cuts are responsible for a great deal of economic growth right here in Virginia, but the last thing we need to do is stifle that growth by not fully implementing the tax cuts for more than 600,000 Virginia taxpayers.”

While Republican leaders expressed interest in making the tax relief permanent, the House plan for Virginia would remain tied to the federal changes, preventing any unintended consequences if Democrats in Washington succeed in repealing the 2017 tax bill, as many have pledged.

During the call, Republican leaders highlighted the writings of editorial boards around the state, which said the tax hike would hurt the middle class.

Previously, the Richmond Times-Dispatch wrote that, “Gov. Northam’s Tax plan wallops the middle class” while the Free-Lance Star said, “Governor Northam’s tax plan hurts the middle class.”

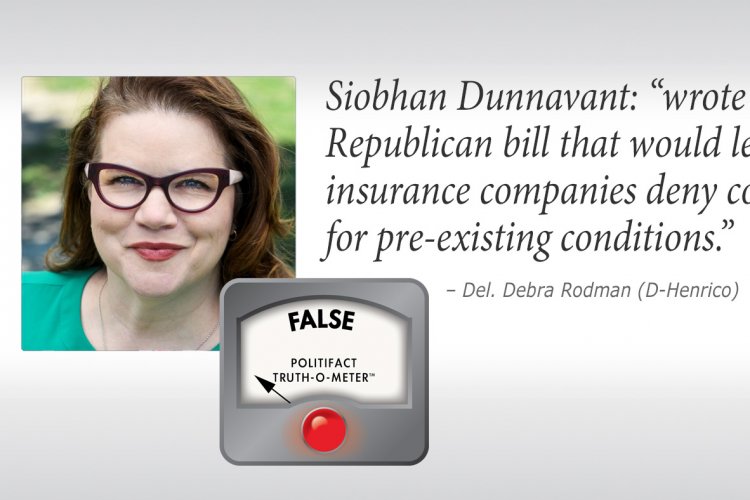

On the call, Republican leaders pushed back on a false talking point that the legislation was intended to help “the rich.”

“Let me dispel a misleading talking point that is sure to be resurrected by those attacking our plan,” said Ware, who chairs the House Finance Committee. “This plan is not just for the ‘rich’. Our plan will help the people who power our economy and the hard working Virginians who need tax relief the most.”

Ware was referring to the 2.7 million Virginians who would see lower taxes under the GOP’s proposal.

Speaker Cox said the proposal was a high-priority item which needed to be taken up immediately after the beginning of session, as budget negotiations could not begin in earnest until the issue of Northam’s new revenue was resolved. Additionally, Republicans said, the issue needed to be resolved quickly, offering certainty to Virginia filers as tax season approaches.

The fight over Northam’s tax increase is expected to dominate debate during the 2019 legislative session, which convenes next Wednesday in Richmond. Already, several Democratic lawmakers have announced their opposition to tax conformity for the middle class, though additional opposition is likely to follow when the Republican bills come up for a vote.